🔍 How KXS Stacks Up Against Each One

Sources: MarketBeat competitor lists, Yahoo Finance comparison data for SHOP/CSU/DSG/KXSYahoo Finance, AlphaSpread valuation comparisons for CSU/TOI, Financhill competitor metrics for KXSFinanchill.

1️⃣ Kinaxis (KXS) vs Descartes (DSG)

Closest apples‑to‑apples comparison.

- Both are supply chain SaaS

- DSG is more logistics + compliance

- KXS is more planning + forecasting

- DSG grows slower but is more stable

- KXS grows faster but is more cyclical

If you like KXS, DSG is the “safer cousin.”

2️⃣ KXS vs Constellation Software (CSU)

CSU is a different beast entirely.

- CSU buys hundreds of small software companies

- Extremely diversified

- Very stable cash flow

- Lower volatility than KXS

- Long‑term compounding machine

CSU is the “sleep well at night” Canadian tech stock.

3️⃣ KXS vs Topicus (TOI)

TOI is CSU’s European spin‑off.

- Faster growth than CSU

- More early‑stage acquisitions

- Higher risk, higher reward

- More volatility

- Still very high‑quality

TOI is like CSU’s younger, more aggressive sibling.

4️⃣ KXS vs Shopify (SHOP)

Completely different risk profile.

- SHOP is macro‑sensitive

- Huge global TAM

- High volatility

- Can swing 30–50% in a year

- Strong long‑term story but not for the faint of heart

KXS is stable enterprise SaaS; SHOP is a rocket ship.

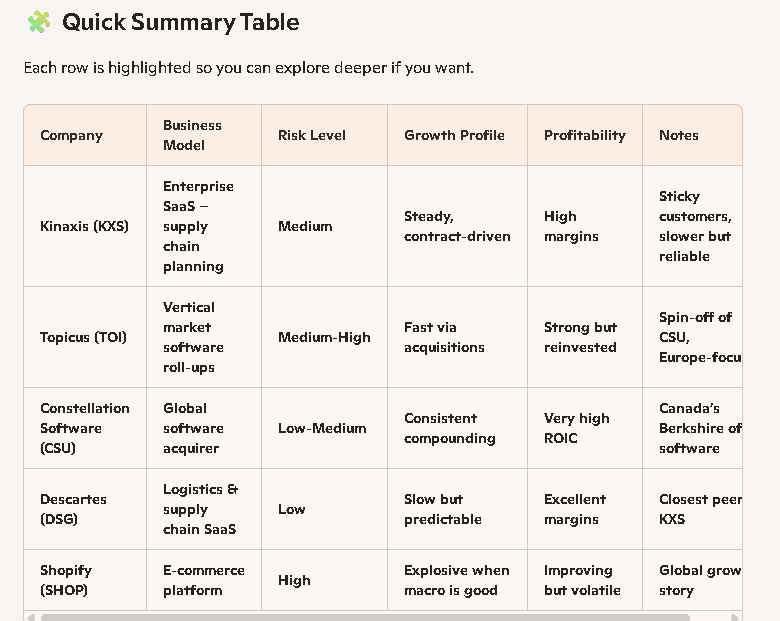

🧠 Where KXS Fits in Your Portfolio

Given your situation — three years from retirement, strong equity exposure, and a desire to reduce volatility — here’s the general pattern:

- KXS → mid‑risk, steady SaaS

- DSG → low‑risk, slow‑and‑steady

- CSU → low‑medium risk, compounding

- TOI → medium‑high risk, growth

- SHOP → high risk, high reward

KXS is not the riskiest name in the group. It’s actually one of the more stable Canadian SaaS companies.

Leave a Reply

You must be logged in to post a comment.