Category: Uncategorized

-

QSR: Tim Hortons parent company sees $364 million profit in Q3 despite rising costs

Restaurant Brands International Inc. recorded a US$364 million profit in its most recent quarter as it continued to warn of increases in commodity, labour, and energy costs.

The Toronto-based owner of Tim Hortons, Burger King, Popeyes Louisiana Kitchen and Firehouse Subs says its third quarter net income compared with a profit of US$530 million a year earlier.

It says the decrease seen over the period ended Sept. 30 was primarily driven by income tax expenses and an increase in share-based compensation, non-cash incentive compensation expense and interest expenses.

The fast-food parent company, which reports in U.S. dollars, is also posting a revenue boost to US$1.83 billion from US$1.72 billion a year earlier.

The rise in revenue came even as RBI says it has seen the war in Ukraine and COVID-19 trigger increases in inflation, foreign exchange volatility and rising interest rates which may be exacerbated by the conflict in the Middle East.

It warns the geopolitical tensions could have an adverse impact on its business, if the company and its franchisees are not able to adjust prices sufficiently without negatively impacting consumer demand.

This report by The Canadian Press was first published Nov. 3, 2023.

-

Magna beats expectations with profit boost as light vehicle production ramps up

Magna International Inc. is reporting a jump in profits and revenues for its third quarter, beating analyst expectations.

The auto parts manufacturer, which keeps its books in U.S. dollars, says net income leaped 36 per cent to US$394 million in the quarter ended Sept. 30 from US$289 million in the same period last year.

Magna says sales rose 15 per cent to US$10.69 billion last quarter from US$9.27 billion the year before.

On an adjusted basis, diluted earnings jumped to US$1.46 per share from US$1.10 per share.

The one-third increase far exceeded analyst expectations of US$1.32 per share, according to financial markets data firm Refinitiv.

The Aurora, Ont.-based company says its profit growth stems from the launch of new programs over the past year, higher light vehicle production across the globe and price increases to cover rising production costs.

This report by The Canadian Press was first published Nov. 3, 2023.

-

Telus profit plunges 74% in the third quarter as restructuring costs bite

VANCOUVER — The cost savings from recent layoffs at Telus Corp. will have a bigger impact on the company’s financial results in the coming quarters, Telus president and CEO Darren Entwistle said.

“The incremental cost savings are expected to more meaningfully contributeto fourth quarter EBITDA, with the run rate expected to be felt by the second quarter of nextyear,” he said on a call with analysts Friday.

Entwistle’s comments came as the cost of that restructuring took a bite out of the telecom company’s third-quarter profit, which dropped 74 per cent year-over-year despite a solid revenue boost and record customer growth.

In early August, Telus announced it would be cutting 6,000 jobs due to issues around regulation and competition, including 4,000 at its main Telus business. The reductions would be made through a combination of layoffs, early retirement and voluntary packages, as well as vacancies that would not be filled. The other 2,000 were at Telus International.

At the time, the company said its planned restructuring would cost the company $475 million in 2023, but lead to annual savings of more than $325 million.

The company has “substantially completed” the headcount reductions, chief financial officer Doug French said on the same call, adding Telusanticipates costs to remain elevated in the fourth quarter due to the restructuring.

Net income attributable to shareholders fell to $136 million in the third quarter ended Sept. 30 from $514 million in the same period the year before, the telecommunications company said.

On an adjusted basis, net income was down 20.8 per cent to $373 million.

Among the other factors Telus attributed to the profit decline were higher depreciation and amortization from its network buildout and acquisitions, and higher financing costs.

The company said operating revenues rose 7.5 per cent in its third quarter to $4.99 billion from $4.64 billion a year earlier.

Adjusted basic earnings fell nearly 27 per cent to 25 cents per share from 34 cents per share, but slightly beat analyst expectations of 24 cents per share, according to financial markets data firm Refinitiv.

Telus said net customer growth hit a quarterly record of 406,000, an increase of 59,000 from the year before that it said was driven by demand for bundled services.

Mobile and post-paid churn were both up slightly, “against the backdrop of heightened competitive activity,” Entwistle said on the call.

Results were overall in line with expectations, as the full benefits of Telus’s restructuring plans have yet to be reflected in results, Desjardins analyst Jerome Dubreuil said in a note to clients on Friday.

RBC analyst Drew McReynolds said in a note Friday morning that the third-quarter results, “while not perfect,” demonstrated resilience amid a more competitively intense operating environment, especially in western Canada after the Rogers-Shaw merger.

In another note after the bell, McReynolds said the third-quarter results represent a potential early glimpse into Telus’s playbook for competing against Rogers-Shaw. This includes “ceding as little market share as possible on wireline loading in Western Canada,” he wrote, noting the company’s “long-standing focus on bundling, product intensity and economies of scope, base management, customer service and execution.”

Shares in the company were up 2.79 per cent at $24.32 in mid-afternoon trading.

-

Enbridge to purchase seven renewable gas facilities in Texas, Arkansas for US$1.2-billion

Canadian pipeline giant Enbridge Inc. ENB-T +0.43%increase has signed a deal to purchase seven existing renewable natural gas facilities in Texas and Arkansas for US$1.2-billion.

The acquisition of the facilities from Texas-based Morrow Renewables establishes Enbridge as one of the largest transporters of renewable natural gas by volume in North America, the Calgary-based company said Friday.

Renewable natural gas, often called RNG, refers to non-fossil-fuel-based renewable energy created from organic waste.

The seven facilities currently deliver RNG from municipal landfills in six Texas locations as well as Fort Smith, Ark.

While RNG can be produced from many different sources, including agricultural waste and food waste, landfill RNG facilities collect the gas that is produced by waste decomposition in the landfill.

The gas is then treated and compressed into pipeline-grade methane, so it can be easily blended into existing natural gas transmission networks and used to fuel transit fleets and heat homes and businesses.

“RNG fundamentals are strong in the United States and indicate continued growth in demand over the long-term as gas utilities increasingly continue to set RNG blending targets,” said Enbridge chief executive Greg Ebel on a third-quarter conference call Friday.

“This was the perfect opportunity to meaningfully add to our RNG portfolio with an accretive … tuck-in.”

Mr. Ebel said 60 per cent of the cash consideration for the purchases will be spread over a two-year period.

According to the World Biogas Association, organic waste from food production, food waste, farming, landfill and wastewater treatment are responsible for about 25 per cent of human-caused global emissions of methane, a harmful greenhouse gas.

But it’s possible to harness the methane from organic waste to create an environmentally friendly alternative to traditional natural gas that can be used for home heating, cooking and even fuelling vehicles.

Enbridge is one of a number of traditional fossil fuel companies that have been investing in RNG as concerns about climate change intensify.

Prior to Friday’s announcement, Enbridge Gas was actively involved in seven Canadian RNG projects operating or under construction, with more than 50 proposed projects in various stages of development.

In March, Enbridge purchased a 10-per-cent stake in Divert Inc., a U.S.-based food waste management company. Together, the two companies plan to partner on several projects across the U.S. that will convert food waste into renewable energy.

Also on Friday, Enbridge announced it has signed a deal to purchase from CPP Investments its stake in two offshore wind farms in Germany, for €625-million.

The company also remains on track to close by the end of the year its previously announced purchase of three U.S.-based utility companies – the East Ohio Gas Company, Questar Gas Company and its related Wexpro companies, and the Public Service Company of North Carolina.

The US$14-billion cash-and-debt deal is currently going through the regulatory approvals process south of the border. Enbridge said Friday it has secured 75 per cent of the financing required to complete the transaction.

Enbridge delivered a profit of $500-million in the third quarter of 2023, compared with $1.3-billion a year earlier.

The company said Friday its profit amounted to 26 cents per share for the quarter ended Sept. 30 compared with 63 cents per share in the same quarter a year earlier.

On an adjusted basis, Enbridge said it earned 62 cents per share, down from an adjusted profit of 67 cents per share a year earlier.

-

Canada’s unemployment rate rises to 5.7% in October as economy sees modest job gain

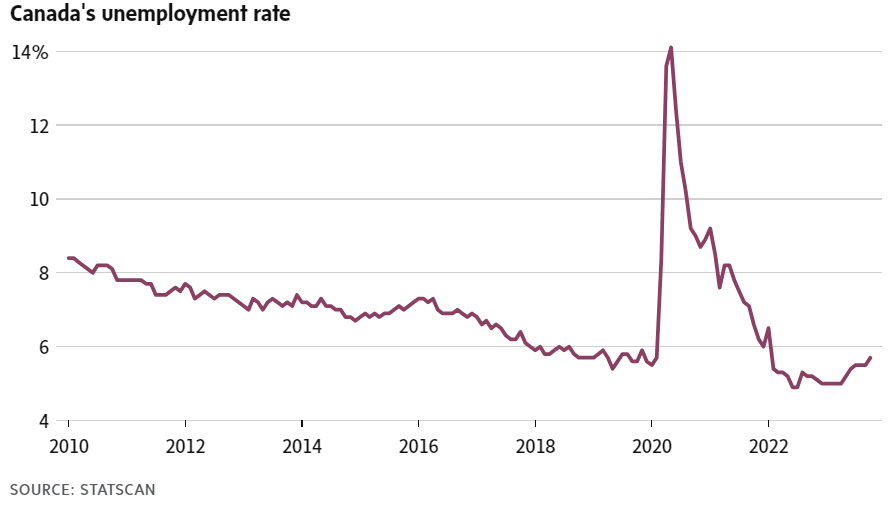

The Canadian economy added jobs at a slower pace in October and the unemployment rate ticked up, the latest sign of how higher interest rates are weighing on economic activity.

The labour market added 17,500 jobs last month, after increases of nearly 64,000 positions in September and 40,000 in August, Statistics Canada said Friday in a report. Analysts on Bay Street were expecting a gain of 25,000 in October.

Despite the increase, the unemployment rate rose to 5.7 per cent from 5.5 per cent, the highest level since January, 2022. The labour force is expanding quickly, because of an immigration boom, but employers are not creating enough jobs to keep the jobless rate from rising.

Meanwhile, average hourly wages rose 4.8 per cent on an annual basis in October – down from a 5-per-cent pace in September. This is an encouraging sign for the Bank of Canada, which has repeatedly flagged elevated wage growth as a risk to the inflation outlook.

The economic data have softened in recent months: Gross domestic product has stagnated, job vacancies are falling and consumers are pulling back on purchases as businesses and households contend with the highest borrowing rates in more than two decades.

After Friday’s report, analysts said the Bank of Canada was unlikely to raise its benchmark interest rate any further from its current 5 per cent.

“While the headline job gain was uneventful, make no mistake that the underlying picture for Canada’s labour market is softening. Exhibit A on that front is the grinding rise in the unemployment rate,” Bank of Montreal chief economist Doug Porter wrote to clients.

He added: “This will keep the Bank of Canada pinned more fully to the sidelines, although we still believe that rate relief remains a distant prospect.”

The labour report showed mixed results by region and industry. Alberta added 37,700 positions in October, the most of any province. At the other end, employment fell by 22,100 in Quebec and 14,300 in Ontario. Because of the weakness in Quebec, Saskatchewan now has the lowest unemployment in the country at 4.4 per cent.

Employment rose by 23,000 in construction, the most by industry. Manufacturing shed 18,800 roles, while another 21,700 positions were lost in wholesale and retail trade.

After hitting a record low of 4.9 per cent last year, the unemployment rate has been moving higher. Statscan noted there were 1.2 million unemployed persons in October, an increase of 171,000 since April. The agency noted that among those unemployed in September, 60 per cent remained unemployed in October, a greater proportion than a year ago.

This is “an indication that job seekers are facing more difficulties finding employment than a year ago,” the report said.

In October, one in three Canadians aged 15 and older was living in a household that found it difficult or very difficult to meet its financial needs for necessary expenses over the previous four weeks, Statscan said on Friday. This proportion was down slightly from a year ago (35.5 per cent), but was much higher than three years ago (20.4 per cent).

The annual inflation rate has ebbed to 3.8 per cent from a peak of 8.1 per cent last year. Still, the Bank of Canada doesn’t expect inflation to return to its 2-per-cent target until mid-2025. Moreover, price increases remain elevated for necessities such as food and shelter.

From a labour perspective, the coming months could be challenging for job seekers.

“We suspect that given the weak trend in economic activity currently and its implications for labour demand, job growth will continue to lag that of the overall population for the remainder of this year and into 2024,” said Andrew Grantham, senior economist at CIBC Capital Markets, in a report.

Mr. Grantham said the unemployment rate could rise further and peak somewhere between 6 per cent and 6.5 per cent. “That should help to ease wage and overall inflationary pressures, allowing for interest rate cuts to start” in the second quarter of 2024, he said.

-

Economic Calendar: Nov 6 – Nov 10

Monday November 6

China trade surplus

Japan and Euro zone services and composite PMI

Bank of Japan minutes from Sept. 21-22 meeting

(10 a.m. ET) Canada’s Ivey PMI for October.

(10 a.m. ET) U.S. Global Supply Chain Pressure Index for October.

(10:30 a.m. ET) Bank of Canada Market Participants Survey for Q3.

(2 p.m. ET) U.S. Senior Loan Officer Opinion Survey for October.

Earnings include: Berkshire Hathaway Inc.; CT REIT; Element Fleet Management Corp.; Finning International Inc.; Ivanhoe Mines Ltd.; MEG Energy Corp.; Obsidian Energy Ltd.; Sandstorm Gold Ltd.; Vertex Pharmaceuticals Inc.

—

Tuesday November 7

Japan household spending

Euro zone producer prices

Germany industrial production

(8:30 a.m. ET) Canada’s merchandise trade balance for September.

(8:30 a.m. ET) U.S. goods and services trade deficit for September. The Street is projecting US$60.5-billion, up from US$58.3-billion in August.

(11:30 a.m. ET) Bank of Canada Deputy Governor Sharon Kozicki gives the opening remarks at the John Kuszczak Memorial Lecture in Ottawa.

(3 p.m. ET) U.S. consumer credit for September,

Also: Quebec’s fiscal update.

Earnings include: Ballard Power Systems Inc,; Boardwalk REIT; Cargojet Inc.; Dream Industrial REIT; Dundee Precious Metals Inc.; EQB Inc.; Gilead Sciences Inc.; Goeasy Ltd.; iA Financial Corp. Inc.; Intact Financial Corp.; Killam Properties Inc.; Occidental Petroleum Corp.; Ovintiv Inc.; Pan American Silver Corp.; Pet Valu Holdings Ltd.; Stella-Jones Inc.; Superior Plus Corp.; TransAlta Corp.; Tricon Capital Group Inc.; Uber Technologies Inc.

—

Wednesday November 8

China aggregate yuan financing and new loans

Euro zone retail sales

Germany consumer prices

ECB’s three-year CPI expectations

(8:30 a.m. ET) Canadian building permits for September.

(8:30 a.m. ET) U.S. wholesale inventories for September.

(9:15 a.m. ET) U.S. Fed chair Jerome Powell delivers opening remarks at the Fed’s Division of Research and Statistics Centennial Conference.

(1:30 p.m. ET) Bank of Canada’s Summary of Deliberations for the Oct. 25 decision.

Earnings include: B2Gold Corp.; Canadian Apartment Properties REIT; CCL Industries Inc.; CGI Inc.; Choice Properties REIT; Crombie REIT; E-L Financial Corp.; Franco-Nevada Corp.; Great-West Lifeco Inc.; Granite REIT; Green Thumb Industries Inc.; Hudbay Minerals Inc.; Hydro One Ltd.; Keyera Corp.; Kinross Gold Corp.; Linamar Corp.; Lundin Gold Inc.; Manulife Financial Corp.; Nuvei Corp.; NuVista Energy Ltd.; Parex Resources Inc.; Peyto Exploration & Development Corp.; Russel Metals Inc.; Smart REIT; TC Energy Corp.; Tourmaline Oil Corp.; Walt Disney Co.; WSP Global Inc.

—

Thursday November 9

China CPI and PPI

Japan bank lending

ECB economic bulletin

(8:30 a.m. ET) U.S. initial jobless claims for week of Nov. 4. Estimate is 222,000, up 5,000 from the previous week.

(11:45 a.m. ET) Bank of Canada Deputy Governor Carolyn Rogers speaks at Advocis Vancouver.

(2 p.m. ET) U.S. Fed chair Jerome Powell speaks on a panel on monetary policy challenges in a global economic at an IMF conference..

Earnings include: Altus Group Ltd.; Autocanada Inc.; Becton Dickinson and Co.; Boralex Inc.; CAE Inc.; Canadian Tire Corp. Ltd.; Canoe EIT Income Fund; Canopy Growth Corp.; Chartwell Retirement Residences; CI Financial Corp.; Constellation Software Inc.; Curaleaf Holdings Inc.; Definity Financial Corp.; Docebo Inc.; Endeavour Mining Corp.; Exchange Income Corp.; IAMGold Corp.; Northland Power Inc.; Paramount Resources Ltd.; Quebecor Inc.; Rogers Communications Inc.; Saputo Inc.; Sleep Country Canada Holdings Inc.; Stantec Inc.; Suncor Energy Inc.; Wheaton Precious Metals Corp.

—

Friday November 10

U.S. Veterans Day (stock markets open and bond markets closed)

UK GDP, industrial production and trade deficit

(10 a.m. ET) U.S. University of Michigan Consumer Sentiment Survey for November.

(10:30 a.m. ET) Bank of Canada Senior Loan Officer Survey for Q3.

Earnings include: Algonquin Power & Utilities Corp.; Emera Inc.; Kelt Exploration Ltd.; Lassonde Industries Inc.; MAG Silver Corp.; Onex Corp.; SNC-Lavalin Group Inc.

-

Canadian Stocks Move Sharply Higher Following U.S. Jobs Data

Published: 11/3/2023 12:57 PM ET

Extending the strong upward move seen over the past several sessions, Canadian stocks have moved sharply higher during trading on Friday.

The benchmark S&P/TSX Composite Index surged higher at the start of trading and remains firmly in positive territory.

Currently, the index is up 202.27 points or 1.1 percent at 19,833.61, continuing to regain ground after ending last Friday’s trading at its lowest closing level in a year.

The extended rally by Canadian stocks reflects a positive reaction to a Labor Department report showing U.S. employment rose by less than expected in the month of October.

The closely watched report said employment climbed by 150,000 jobs in October after jumping by a downwardly revised 297,000 jobs in September.

Economists had expected employment to increase by 180,000 jobs compared to the surge of 336,000 jobs originally reported for the previous month.

The Labor Department also said the unemployment rate crept up to 3.9 percent in October from 3.8 percent in September. The unemployment rate was expected to remain unchanged.

The data has added to optimism the Federal Reserve is done raising interest rates after the central bank left rates unchanged for the third time in four meetings earlier this week.

In Canadian economic news, Statistics Canada released a report showing Canadian employment edged up by 18,000 jobs in October.

The report also said the Canadian unemployment rate rose to 5.7 percent in October from 5.5 percent in September, marking the fourth monthly increase in the past six months.

Statistics Canada said job growth in the construction and information, culture and recreation sectors was offset by decreases in jobs in the wholesale and retail trade and manufacturing sectors.

Interest rate-sensitive real estate stocks are seeing substantial strength on the day, resulting in a 3.5 percent surge by the S&P/TSX Capped Real Estate Index.

Significant strength is also visible among healthcare stocks, as reflected by the 3.0 percent spike by the S&P/TSX Capped Health Care Index.

Gold stocks are also turning in a strong performance amid a modest increase by the price of the precious metal, moving sharply higher along with consumer, telecom and financial stocks.

Meanwhile, energy stocks are bucking the uptrend amid a steep drop by the price of crude oil, dragging the S&P/TSX Capped Energy Index down by 1.1 percent.

-

Enbridge Reports Strong Third Quarter 2023 Financial Results and Reaffirms Financial Guidance and Outlook

CALGARY, AB, Nov. 3, 2023 /CNW/ – Enbridge Inc. (Enbridge or the Company) (TSX: ENB) (NYSE: ENB) today reported third quarter 2023 financial results, reaffirmed its 2023 financial outlook and provided a quarterly business update.

Highlights

(All financial figures are unaudited and in Canadian dollars unless otherwise noted. * identifies non-GAAP financial measures. Please refer to Non-GAAP Reconciliations Appendices.)- Third quarter GAAP earnings of $0.5 billion or $0.26 per common share, compared with GAAP earnings of $1.3 billion or $0.63 per common share in 2022

- Adjusted earnings* of $1.3 billion or $0.62 per common share*, compared with $1.4 billion or $0.67 per common share in 2022

- Adjusted earnings before interest, income taxes and depreciation and amortization (EBITDA)* of $3.9 billion, an increase of 3%, compared with $3.8 billion in 2022

- Cash provided by operating activities of $3.1 billion, compared with $2.1 billion in 2022

- Distributable cash flow (DCF)* of $2.6 billion, an increase of $0.1 billion, compared with $2.5 billion in 2022

- Reaffirmed 2023 full year financial guidance for EBITDA and DCF inclusive of the recent share offering dilution

- Enbridge entered into definitive agreements (the “Acquisitions”) with Dominion Energy, Inc. (“Dominion”) to acquire The East Ohio Gas Company, Questar Gas Company and its related Wexpro companies, and Public Service Company of North Carolina, Incorporated for an aggregate purchase price of US$14 billion (CDN$19 billion)

- Enbridge has filed applications for all key federal and state required regulatory approvals to complete the pending Acquisitions and approximately 75% of the financing for the aggregate purchase price has been secured

- Signed an agreement to increase ownership in Hohe See Offshore Wind Farm and Albatros Offshore Wind Farm by a further 24.45%, bringing Enbridge’s interest to 49.89%, for €625 million (including €358 million of assumed debt)

- Signed a definitive agreement to acquire seven operating landfill-to-renewable natural gas (RNG) assets located in Texas and Arkansas for US$1.2 billion with staggered consideration

- Upsized and relaunched the Flanagan South Pipeline (FSP) binding open season for US Gulf Coast delivery service

- Closed the acquisition of Aitken Creek Gas Storage on November 1

- Debt-to-EBITDA expected to exit the year below the target range of 4.5x to 5.0x reflecting substantial equity pre-funding prior to closing the Acquisitions