Bank of Canada expected to deliver another large rate hike as it continues inflation fight

he Bank of Canada is expected to deliver another large interest rate increase this week, as central bank officials remain more concerned about doing too little to combat inflation than doing too much and causing a recession.

Governor Tiff Macklem has been unambiguous in recent weeks that interest rates need to keep rising to get prices under control. Markets are pricing in a high probability that he will announce another 75-basis-point rate increase on Wednesday, although some forecasters argue that a smaller 50-basis-point move is more likely. (There are 100 basis points in a percentage point.)

Eight months into one of the fastest rate-hike cycles on record, the central bank is in a precarious spot. The economy is slowing down, but inflation remains stubbornly high. Analysts think the bank is nearing the end of its monetary policy-tightening campaign, but Mr. Macklem and his team risk roiling markets and boosting inflation expectations if they change course on rate hikes too abruptly.

‘Disappointing’: How the Street is reacting to a hot inflation report that has altered bets on the next move by the BoC

Stubborn inflation paves way for large Bank of Canada rate hike

“Dovish signals may be self-defeating for the moment,” National Bank economists Warren Lovely and Taylor Schleich said in a note to clients.

“But by pushing rates into decisively restrictive territory more quickly, it’s less obvious (to us) that rates will need to move up much further,” they said, referring to a level of interest rates that intentionally slow down economic activity.

The central bank has raised interest rates five times since March, bringing its benchmark borrowing rate to 3.25 per cent from 0.25 per cent. How big it goes this week will come down to its assessment of competing risks.

Canada’s economic outlook has darkened since the last rate decision in September. Higher mortgage rates are hammering the housing market, and a pair of Bank of Canada surveys published last week show a significant deterioration in consumer and business sentiment. A growing number of private-sector economists – including Mr. Macklem’s predecessors Stephen Poloz and Mark Carney – are now predicting the Canadian economy will enter a recession next year.

At the same time, the rate of inflation remains more than three times the Bank of Canada’s 2-per-cent target, eroding the value of wages and adding to widespread affordability challenges.

Consumer Price Index (CPI) inflation has slowed in recent months, falling to an annual rate of 6.9 per cent in September, from a high of 8.1 per cent in June, thanks in large part to lower gasoline prices. But the latest CPI data, published last week, showed that inflation is broadening, with most goods and services experiencing oversized price increases.

“We have yet to see a clear turning point in underlying inflation,” Mr. Macklem told reporters two weeks ago in his last public remarks before the rate decision. “Against that background, we are more worried about upside risks to inflation, than downside risks [to the wider economy].”

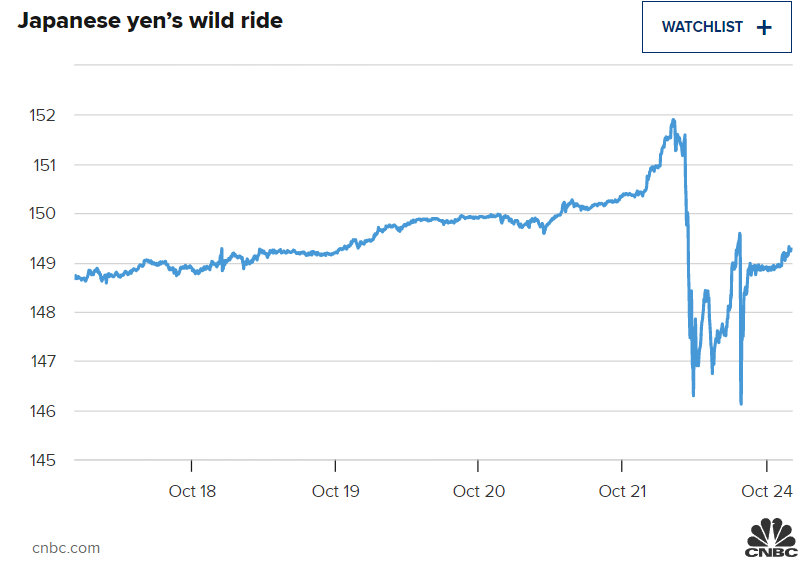

A weakening Canadian dollar adds a further complication. Canada’s currency has fallen nearly 10 per cent against the U.S. dollar over the past year, with a particularly sharp drop in recent months as the U.S. Federal Reserve has become hawkish about further rate hikes and investors have flocked to U.S. assets as a haven amid turmoil in global financial markets.

A weaker exchange rate makes imported American products more expensive, adding to inflation. The Bank of Canada does not officially target the exchange rate, but Mr. Macklem said this month that a weaker dollar means the bank may need to raise interest rates more than would otherwise be needed.

The Federal Reserve is widely expected to announce another 75-basis-point rate hike in early November. Derek Holt, Bank of Nova Scotia’s head of capital markets economics, said the Bank of Canada may be inclined to match this expected move by the Fed. A smaller rate hike “could mean further [Canadian dollar] weakness, especially in relation to what is priced, which would go against their messaging and look highly inconsistent,” he said in a note to clients.

Crucially, from the Bank of Canada’s perspective, the sources of inflation are changing. While much of the run-up in prices in 2021 and the first half of 2022 was the result of global forces – including supply chain bottlenecks and the commodity price shock following Russia’s invasion of Ukraine – inflation is increasingly being driven by domestic factors. This can be seen in rising service prices and faster wage growth.

Mr. Macklem and his colleagues say the Canadian economy is experiencing “excess demand.” That means people want more goods and services than the economy can supply, and companies want more workers than are available, leading to high job vacancies and rising wages as businesses compete for scarce labour.

“We actually need to see some cooling in the labour market,” Mr. Macklem said this month. “Right now, it’s overheated. That’s generating domestic price pressures. That’s not sustainable.”

A weaker labour market will mean job losses and higher unemployment. Some economists, particularly those aligned with unions, are urging the bank to stop raising rates to avoid unduly hurting Canadian workers.

A paper published by the Canadian Labour Congress last week said the bank’s cure for inflation could be worse than the disease. It argued the bank should stop to assess the impact of its previous five rate hikes before barrelling ahead with more.

There is little evidence Mr. Macklem and his team will heed this advice. After being criticized for acting too slowly in the face of rising inflation, central bankers are scrambling to restore their credibility.

Their big fear is losing control of the inflation narrative, and having Canadians expect permanently high inflation, as happened in the 1970s and early 1980s. What people think about future prices feeds into wage negotiations and business price-setting decisions, such that beliefs about high inflation can become self-reinforcing.

“Inflation expectations have remained reasonably well anchored on our target. But we’re not inclined to test Canadians’ patience,” Mr. Macklem said.