The Bank of Canada cut its benchmark interest rate by a quarter-percentage-point on Wednesday and warned that the resilience of Canada’s economy “would be tested” if a trade war breaks out with the United States.

As widely expected, the central bank lowered its policy rate to 3 per cent from 3.25 per cent, its sixth consecutive cut. It also announced the end of quantitative tightening (QT) – a years-long push to shrink the size of its balance sheet after its early pandemic bond-buying spree.

With inflation largely under control, the bank has been easing borrowing costs since last summer, and policy makers had been expecting economic growth to pick-up steam. The threat of U.S. tariffs, however, has thrown a major curveball at the Canadian economy and the central bank.

“A long-lasting and broad-based trade conflict would badly hurt economic activity in Canada. At the same time, the higher cost of imported goods will put direct upward pressure on inflation,” Bank of Canada Governor Tiff Macklem said, according to the prepared text of his press conference opening remarks.

U.S. president Donald Trump has threatened to put a 25-per-cent tariff on all Canadian imports, perhaps as early as this Saturday, Feb. 1. He has also tasked his administration with developing a series of trade measures aimed at shrinking the U.S. trade deficit with Canada and other countries by April 1.

“Unfortunately, tariffs mean economies simply work less efficiently – we produce and earn less than without tariffs. Monetary policy cannot offset this. What we can do is help the economy adjust,” Mr. Macklem said.

Given the uncertainty around Mr. Trump’s threats, the Bank of Canada did not incorporate tariffs into the central forecast in its quarterly Monetary Policy Report, published Wednesday. It did, however, model the potential impact of a major trade war.

If the United States imposes a 25 per cent tariff on all imports and its trading partners retaliate in kind, that would have a significant negative impact on Canadian gross domestic product while also increasing inflation.

In the bank’s “benchmark” tariff scenario, Canadian GDP would be 2.4 percentage points lower than with no tariffs in the first year, and 1.5 percentage points lower in the second year. Inflation would be 0.1 percentage points higher in the first year and 0.5 percentage points higher in the second year.

The bank also published alternative tariff scenarios, based on different assumptions about how households and businesses might respond to the shock, where GDP growth could be as much as 3 percentage points lower in the first year, and inflation could be as much as 0.8 percentage points higher.

The scenarios are not forecasts. But they highlight the challenging trade-offs tariffs pose for monetary policy.

“With a single instrument – our policy interest rate – we can’t lean against weaker output and higher inflation at the same time,” Mr. Macklem said in his opening statement. “As we consider our monetary policy response, we will need to carefully assess the downward pressure on inflation from the weakness of the economy, and weigh that against the upward pressure on inflation from higher input prices and supply chain disruptions.”

Leaving aside the threat of tariffs, the bank’s latest forecast shows inflation remaining close to the bank’s 2-per-cent target over the next two years.

Meanwhile, its forecast for GDP growth was downgraded slightly. It now sees 1.8 per cent GDP growth in 2025 and 1.8 per cent in 2026, down from 2.1 per cent and 2.3 per cent in its October forecast.

The GDP growth downgrade was largely driven by lower population growth estimates, following the federal government’s recent immigration caps. After growing 2.3 per cent in the second half of 2024, the bank now expects annual population growth to decline to 0.5 per cent by the second quarter of 2025 and remain at that level over the next two years.

The bank’s intention to end QT was signalled in a speech earlier this month, although the timeline the bank outlined on Wednesday is faster than many market participants expected. The bank has been shrinking the size of its balance sheet over the past two years by letting the billions of dollars worth of bonds it purchased during the COVID-19 pandemic mature without replacing them.

The bank will now start purchasing financial assets again starting in early March, with the goal of stabilizing the size of its balance sheet and letting it grow “modestly” in line with the economy.

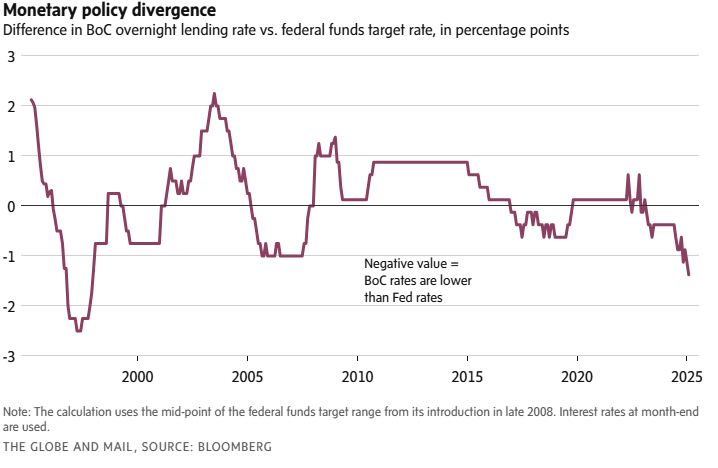

On Wednesday afternoon, the U.S. Federal Reserve will deliver its latest interest rate decision. The U.S. central bank is widely expected to hold its benchmark rate steady at a range of 4.25 per cent to 4.5 per cent, marking a pause after several rate cuts last year.

That would put more distance between Canadian and American interest rates, which could put downward pressure on the already weak Canadian dollar, which has been trading near a four-year low of just under 70 U.S. cents.

In its MPR, the Bank of Canada cast some doubt on how much its divergence with the Fed is responsible for the depreciation of the loonie in recent months. It said that most of the weakness is tied to the “foreign exchange rate risk premium” which has risen due to the threat of U.S. tariffs.

Mr. Macklem and Senior Deputy Governor Carolyn Rogers will hold a press conference at 10:30 am, ET.