novus Energy Inc. CVE-T +1.05%increase boosted its offer for MEG Energy Corp. MEG-T +5.52%increase to $8.6-billion in an attempt to win a hotly contested Alberta oil sands takeover battle.

Early Wednesday, Cenovus announced a cash-and-share bid of $29.80 per MEG share, up $1.32 per share from the offer the two companies announced in late August. The increased offer is meant to trump a hostile, all-share offer from Strathcona Resources Ltd. SCR-T +1.75%increase

Strathcona owns 14 per cent of MEG and has said it planned to vote against the Cenovus offer.

In recent weeks, institutional investors in MEG pressed Cenovus to sweeten its friendly bid ahead of a shareholder meeting originally scheduled for Oct. 9. MEG announced on Wednesday the meeting to vote on the offer is being pushed back to Oct. 22.

On Wednesday, Calgary-based Cenovus said the new deal represents its “best and final offer for MEG.”

MEG’s board of directors recommended shareholders vote in favour of the takeover. In a press release, MEG chair James McFarland said: “This marks the third enhancement to the terms originally put forward by Cenovus, delivering a significant increase to an already attractive transaction.”

The Cenovus offer represents the highest price any buyer has ever paid for oil sands assets, MEG chief executive Darlene Gates said in a press release. She said the improved terms of the deal “enables MEG shareholders to benefit from greater upside through a significant increase to the proportion of share consideration, while also raising the initial transaction consideration.”

Opinion: MEG Energy bidding war sets the stage for oil patch takeovers

Cenovus is offering $29.50 in cash or 1.240 Cenovus common shares for each MEG share, with a maximum payout of $3.8-billion in cash and 157.7 million Cenovus common shares.

The offer now consists of 50 per cent cash and 50 per cent Cenovus common shares. Previously, Cenovus’s bid was structured as 75 per cent cash and 25 per cent stock.

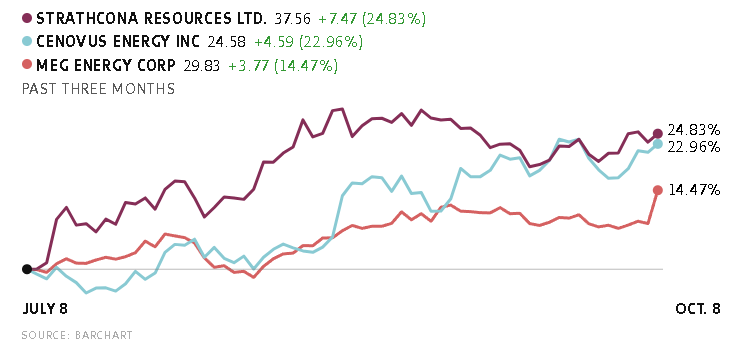

Strathcona initially launched a hostile takeover for MEG in May. In September, after the company announced a board-approved marriage with Cenovus, Strathcona increased its bid.

The offer is for 0.8 Strathcona shares per MEG share, valuing the company as of the Sept. 8 offer date at roughly $30.86 per share, or approximately $7.85-billion.

Two influential proxy advisory firms – Institutional Shareholder Services Inc. and Glass Lewis & Co. – have both endorsed the Cenovus bid over Strathcona. However, the ISS endorsement was tepid, offering “cautionary support” for a deal it described as “neither compelling nor opportunistic.”

MEG and Cenovus have massive neighbouring oil sand properties in the Christina Lake region of Northern Alberta. Cenovus said combining the two operations will generate operational savings, or synergies, of more than $400-million per year by 2028.

Leave a Reply

You must be logged in to post a comment.