Published: 7/19/2023 8:53 AM ET

Crude oil prices extended gains on Wednesday amidst hopes of a less hawkish monetary policy stance by central banks. Evidence of a firmly downward inflation trajectory revealed in the latest updates from the Euro Area and the U.K renewed hopes of a softer monetary policy stance by central banks, lifting Brent Crude futures above the $80 level.

The rally is despite the weaker-than-expected inventory build in the U.S. Data released on Tuesday by the American Petroleum Institute had showed crude oil inventories decline by 0.80 million barrels during the week ended July 14, lower than the decline of 2.25 million barrels that markets were expecting. Crude oil inventories had increased by more than 3 million barrels in the previous week.

Brent Oil Futures for September settlement which had finished Tuesday’s trading at $79.63 traded between $78.19 and $80.38. It is currently at $80.17, having gained 0.68 percent from the previous close.

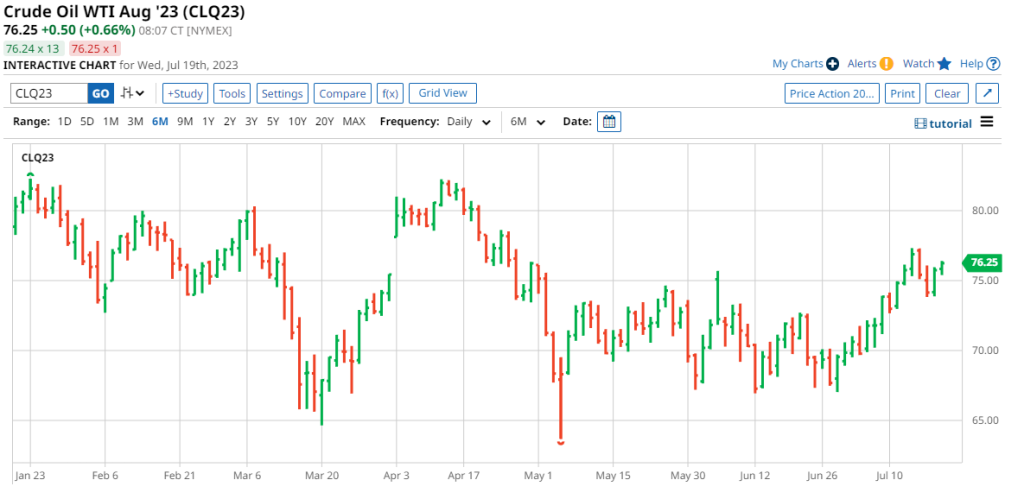

West Texas Intermediate Crude Oil Futures for September settlement which had a closing price of $75.66 on Tuesday ranged between a high of $76.23 and a low of $75.33. The current price of $76.05 represents a gain of 0.52 percent from the previous close.

Both the crude oil benchmarks added to Tuesday’s gains. Brent Futures recorded larger gains, offsetting in part the comparatively lower gains in Tuesday’s rally.

Leave a Reply

You must be logged in to post a comment.