OCT 21 – Before The Bell

Equities

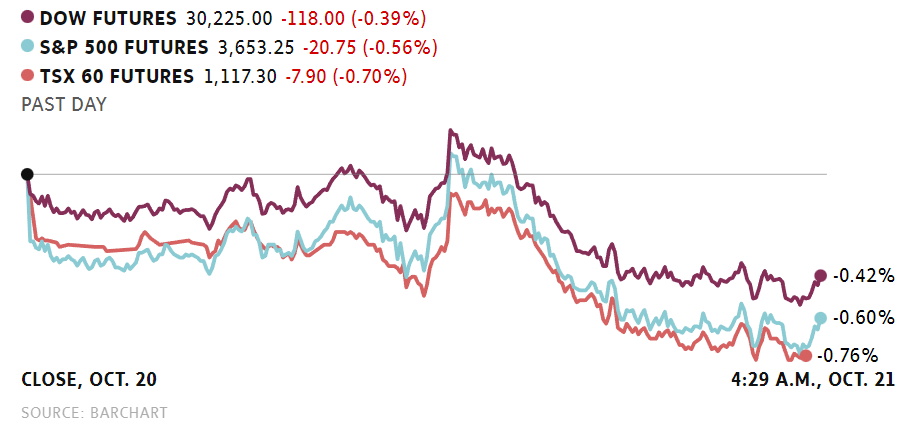

Wall Street futures were down early Friday but key indexes still looked set for weekly gains with corporate earnings and rate concerns high on the agenda. Major European markets were lower with continued political uncertainty in the U.K. in the spotlight. TSX futures were also underwater.

In the early premarket period, futures tied to the Dow, S&P 500 and Nasdaq were all in the red after two straight sessions of losses. However, all three were up roughly 2 per cent on the week thanks to solid gains on Monday and Tuesday. The S&P/TSX Composite Index ended Thusday’s session down 0.51 per cent, reversing gains seen early in the day.

“Once again, few market participants want to hold risk into a weekend with U.S. Treasury 10-year through 4.25 per cent for the first time since 2008,” Stephen Innes, managing partner with SPI Asset Management, said.

“U.S. equities are tormented into the weekend by Federal Reserve officials reigniting fears of stricter monetary tightening and the possibility of a worldwide recession.”

He noted Philadelphia Fed chief Patrick Harker said Thursday that the central bank would likely raise rates to “well above” 4 per cent this year and hold them at restrictive levels, renewing worries about the broader impact of higher borrowing costs.

In this country, investors will get August retail sales figures ahead of the start of trading.

“Our economists don’t expect August retail sales to deviate significantly from Statscan’s preliminary estimate of a 0.4-per-cent month-over-month increase,” Elsa Lignos, global head of FX strategy, said.

“Actual sales volume was likely stronger than that, given offsets from lower prices at gas stations during the month. Sales in September however are expected to flatten out a bit more, according to data from RBC’s own debit and credit spending tracker.”

On the earnings front, Canadian markets will get results from Corus Entertainment. On Wall Street, Verizon is among the big companies reporting.

Overseas, the pan-European STOXX 600 was down 1.52 per cent. Britain’s FTSE 100 fell 0.78 per cent in morning trading as markets now await the outcome of a leadership contest after Prime Minister Liz Truss announced her resignation on Thursday.

Germany’s DAX fell 1.6 per cent. France’s CAC 40 was off 1.7 per cent.

In Asia, Japan’s Nikkei closed down 0.43 per cent. Hong Kong’s Hang Seng lost 0.42 per cent.

Commodities

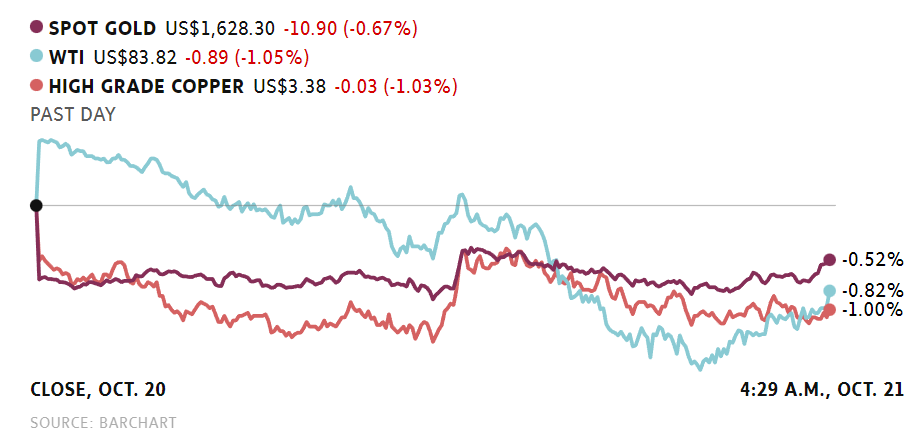

Crude prices were lower as continued concerns about high interest rates and the potential for a global recession offset optimism over reports of easing COVID-19 restrictions in China.

The day range on Brent was US$91 to US$93.06 in the early premarket period. The range on West Texas Intermediate was US$83.15 to US$85.19. Both benchmarks were on track for weekly declines heading into Friday’s session.

“It has been a noisy headline week in the oil patch, but price action has been relatively contained,” SPI Asset Management’s Stephen Innes said in a note.

“There is a feeling of not wanting to fight the Fed until November across many assets, keeping risk-taking grounded.”

Markets drew some support this week from a report that China could soon ease the quarantine period for incoming visitors, easing some concerns over the government’s zero-COVID policy. The reports have not been confirmed by China.

In other commodities, gold prices were lower and looked set for a second consecutive weekly loss.

Spot gold shed 0.4 per cent to US$1,620.79 per ounce by early Friday morning. Gold prices have fallen 1.3 per cent this week.

U.S. gold futures fell 0.7 per cent to US$1,624.60

Currencies

The Canadian dollar was down amid weaker crude prices and negative risk sentiment while its U.S. counterpart edged higher against global currencies and bond yields hit a new 14-year high.

The day range on the loonie was 72.30 US cents to 72.67 US cents in the predawn period.

Investors get August retail sales figures today but markets are now focused on next week’s Bank of Canada rate decision with economists now expecting either a half or three quarter point rate increase.

On world markets, the U.S. dollar index, which tracks the greenback against six major counterparts, advanced 0.2 per cent to 113.130 while the yield on the U.S. 10-year note pushed to a a more than 14-year top of 4.272 per cent by early Friday, according to figures from Reuters.

Britain’s pound fell 0.8 per cent to a weekly low of US$1.11535 as Britain’s ruling Conservative party scrambles to replace Prime Minister Liz Truss.

The euro, meanwhile, fell 0.2 per cent to US$0.97705, after hitting an overnight high of US$0.98455, Reuters reported.

Leave a Reply

You must be logged in to post a comment.