The Bank of Canada cut its benchmark interest rate on Wednesday. Its U.S. counterpart, the Federal Reserve, did not.

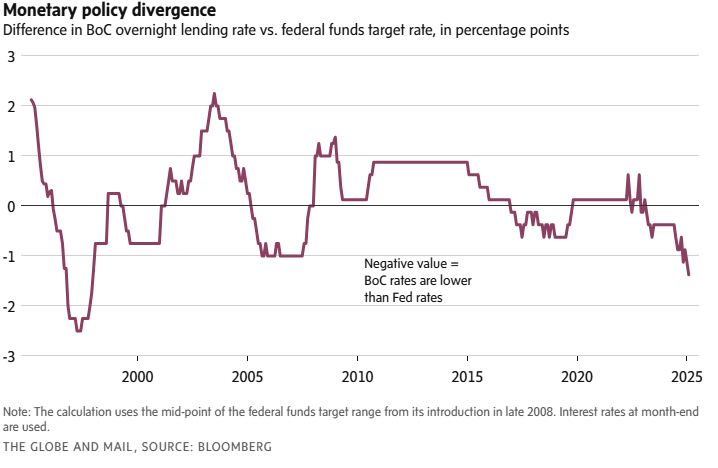

As a result, Canadian rates are lagging behind those of the U.S. at the widest differential since 1997. In a research note, Bank of Montreal chief economist Doug Porter said “the gap is extreme” and only the second time in the past 50 years that Canadian rates have trailed by more than 100 basis points. (There are 100 basis points in a percentage point.)

With inflation under control and the economy needing a lift, the Bank of Canada has cut rates substantially since last summer. The Fed, meanwhile, can’t cut too much because of persistent inflation.

Monetary policy divergence is one of several factors weighing on the Canadian dollar, which is trading at less than 70 U.S. cents. “The Canadian dollar has depreciated materially against the U.S. dollar, largely reflecting trade uncertainty and broader strength in the U.S. currency,” the Bank of Canada said in a press release accompanying Wednesday’s decision, which cut the policy interest rate by 25 basis points to 3 per cent.

The outlook for interest rates and the Canadian dollar is highly uncertain because of U.S. President Donald Trump’s threat to impose steep tariffs on imports of Canadian goods, which could begin as soon as Feb. 1.

“Interest rate developments are unlikely to provide a sufficient offset to the economic hit that could be delivered by a tariff announcement this Saturday, and it remains reasonable to think that the loonie’s trading range could widen substantially in the coming weeks,” said Karl Schamotta, chief market strategist at Corpay Inc., a foreign exchange and payments company, in a research note. “The exchange rate will remain under pressure for now.”

Leave a Reply

You must be logged in to post a comment.