the performance of U.S. tech stocks does influence the share prices of Canadian tech names like Shopify Inc. Class A (SHOP.TO) and Kinaxis Inc. (KXS.TO), but the relationship isn’t mechanical — it’s driven by sentiment, index flows, and growth-tech correlation effects.

Here’s how U.S. tech performance typically impacts these Canadian tech stocks:

1. Market Sentiment & Risk Appetite

- U.S. tech stocks (Nasdaq/S&P 500 Info Tech) often set global growth-tech sentiment: when big U.S. tech names rally (e.g., Apple, Meta, Microsoft, Nvidia), investors become more willing to buy growth-oriented tech stocks globally, including Canadian ones.

- Conversely, when U.S. tech sells off, risk appetite declines and capital tends to rotate out of growth-y stocks like SHOP.TO and KXS.TO into defensive or value sectors.

→ Impact: SHOP.TO and KXS.TO often move in the same direction as U.S. tech indices, especially during broad tech rallies or drawdowns.

2. Correlation with U.S. Tech Indexes

- Shopify’s shares are also listed on the Nasdaq (SHOP), and historically have shown meaningful correlation with U.S. tech benchmarks. When the Nasdaq or S&P 500 Info Tech strongly outperforms, Shopify often participates in that tech rally because it behaves like a global tech growth stock.

- Kinaxis is a software/AI-related growth name, so it also tends to track broad tech sector moves — albeit usually less closely than Shopify because it’s smaller and more niche.

3. Leadership Flows & Index Inclusion Effects

- Shopify was added to the Nasdaq-100 index, meaning index funds and ETFs tied to Nasdaq tech have to hold SHOP, boosting its demand when those funds attract flows.

- When U.S. tech ETFs outperform and attract capital, some flows spill over into tech ETFs globally, supporting SHOP.TO and often smaller capped tech like KXS.TO too.

4. Earnings & Macro Sentiment Spillover

- If big U.S. tech beats expectations — e.g., strong earnings from Apple, Meta, Microsoft — it tends to lift sector sentiment, improving valuations and multiples for tech growth peers globally.

- That positive mood can spill into SHOP.TO and KXS.TO even if their own fundamentals or earnings are unchanged.

Example: Canadian tech stocks “zoomed past” tech benchmarks in years when U.S. tech was strong — the rally in U.S. mega-cap tech contributed to stronger performance in Shopify and broader Canadian tech sentiment historically.

5. Risk-Off Episodes & Valuation Compression

- During periods where U.S. tech underperforms or growth stocks get repriced lower (e.g., higher interest rate fear, slowing earnings), then growth valuations fall globally.

- Canadian tech names like SHOP.TO and KXS.TO can get hit harder than broader TSX because they are growth-oriented, higher-multiple stocks — similar to the way U.S. tech is affected in selloffs.

Example (Historical): When Shopify itself gave a weaker forecast and the TSX tech sector weakened, it dragged Canadian tech down significantly, echoing tech sentiment issues.

Summary Table: Link Between U.S. Tech ↔ SHOP.TO & KXS.TO

| Driver | Shopify (SHOP.TO) | Kinaxis (KXS.TO) |

|---|---|---|

| U.S. Tech Rally | Often benefits as growth sentiment flows in | Typically positive, though less correlated than SHOP |

| Tech Selloffs | Can lead to share price weakness due to risk-off | Also sees pressure, especially on valuation multiples |

| Nasdaq Index Strength | Directly benefits via index inclusion effects | Indirect benefits via broader tech sentiment |

| Earnings Beats in U.S. Tech | Boosts sector sentiment → can lift SHOP | Provides positive backdrop but often company-specific |

| Macro Shifts / Risk Aversion | Can amplify volatility in Shopify | Often amplifies KXS volatility too |

In short:

Canadian tech stocks like SHOP.TO and KXS.TO don’t move solely on U.S. tech performance, but they are strongly influenced by it through sentiment, flows, and risk appetite dynamics. When U.S. tech is outperforming, Canadian tech often follows suit, and when U.S. tech retraces or underperforms, Canadian tech stocks tend to retrace too.

This linkage is strongest for Shopify due to its Nasdaq status and large market cap, and somewhat less tight for Kinaxis, though still meaningful given its growth tech characteristics.

High-Level Takeaways

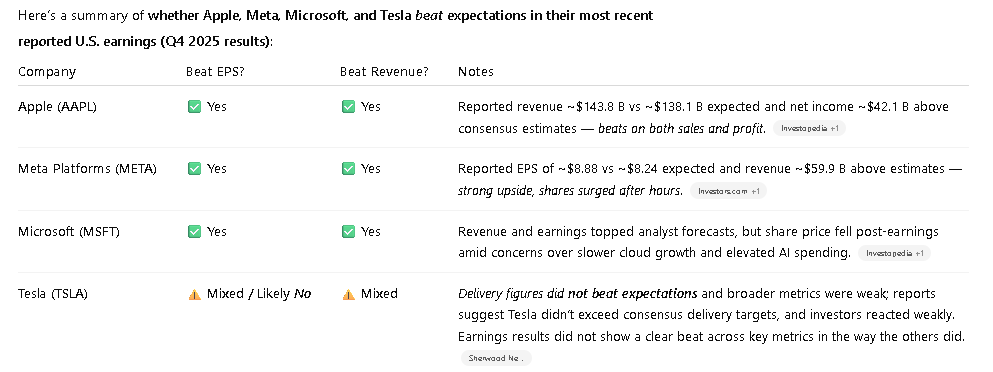

- Apple and Meta clearly beat street forecasts on both revenue and earnings, driving positive stock reactions (especially for Meta).

- Microsoft beat estimates too, but market reaction was negative due to concerns about cloud slowdown and higher AI spending.

- Tesla’s results were weaker relative to expectations, particularly deliveries — a key operational metric — and there’s no clear consensus that it beat on both earnings and revenue.

Leave a Reply

You must be logged in to post a comment.