Monday December 15

China retail sales, industrial production and fixed asset investment

Euro zone industrial production

(5 a.m. ET) Canada’s existing home sales and average prices for November. Estimates are year-over-year declines of 11.0 per cent and 2.5 per cent, respectively.

(5 a.m. ET) Canada’s MLS Home Price Index for November. Estimate is a year-over-year drop of 3.5 per cent.

(8:15 a.m. ET) Canadian housing starts for November. Estimate is an annualized rate rise of 11.7 per cent.

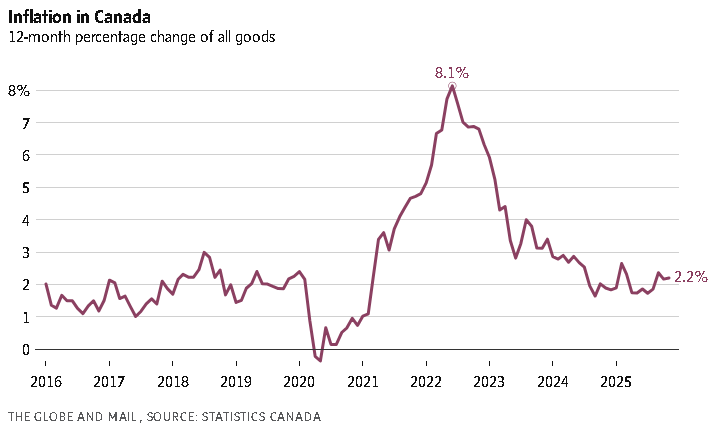

(8:30 a.m. ET) Canadian CPI for November. The Street expects gains of 0.1 per cent from October and 2.3 per cent year-over-year.

(8:30 a.m. ET) Canada’s manufacturing sales and new orders for October. Estimates are month-over-month declines of 1.1 per cent and 1.5 per cent, respectively.

(8:30 a.m. ET) U.S. Empire State Manufacturing Survey for December.

(10 a.m. ET) U.S. NAHB Housing Market Index for December.

Earnings include: Mainstreet Equity Corp.

–

Tuesday December 16

China PMI

Euro zone PMI and trade surplus

(8:30 a.m. ET) U.S. nonfarm payrolls for November. The Street expects an increase of 50,000 from October with the unemployment rate rising 0.1 per cent from the last reading of 4.4 per cent in September and average hourly wages up 3.6 per cent year-over-year. The data from October will also be released following the government shutdown.

(8:30 a.m. ET) U.S. retail sales for October. Consensus is a rise of 0.2 per cent month-over-month.

(8:30 a.m. ET) U.S. housing starts for November.

(8:20 a.m. ET) U.S. building permits for November.

(9:45 a.m. ET) U.S. S&P Global PMIs for December.

(10 a.m. ET) U.S. business inventories for September.

(12:45 p.m. ET) Bank of Canada Governor Tiff Macklem speaks in Montreal (with press conference to follow)

Earnings include: Lennar Corp.; OrganiGram Holdings Inc.

–

Wednesday December 17

Japan trade balance and core machine orders

Euro zone CPI and labour costs

Germany business sentiment

(8:30 a.m. ET) Canada’s international securities transactions for October.

Earnings include: Asante Gold Corp.; General Mills Inc.; Micron Technology Inc.; Transat AT Inc.

–

Thursday December 18

Bank of Japan monetary policy meeting (through Friday)

Bank of England monetary policy meeting

ECB monetary policy meeting

(7 a.m. ET) Canada’s CFIB Business Barometer for December.

(8:30 a.m. ET) Canada’s job vacancy rate for October.

(8:30 a.m. ET) U.S. CPI for November. The Street expects a rise of 0.3 per cent from October and up 3.1 per cent year-over-year.

(8:30 a.m. ET) U.S. initial jobless claims for week of Dec. 13. Estimate is 225,000, down 11,000 from the previous week.

(8:30 a.m. ET) U.S. Philadelphia Fed Index for December.

(8:30 a.m. ET) U.S. current account deficit for Q3.

(10 a.m. ET) U.S. leading indicator for November.

Earnings include: Accenture PLC; BlackBerry Ltd.; Cintas Corp.; FedEx Corp.; Nike Inc.

–

Friday December 19

Japan CPI

Euro zone economic confidence

Germany consumer confidence

(8:30 a.m. ET) Canadian retail sales for October. The Street expects a flat reading month-over-month.

(8:30 a.m. ET) Canada’s new housing price index for November. Estimate is a decline of 0.2 per cent from October and down 2.1 per cent year-over-year.

(8:30 a.m. ET) Canadian household and mortgage credit for October.

(10 a.m. ET) U.S. existing home sales for November.

(10 a.m. ET) U.S. University of Michigan Consumer Sentiment Index for December.

Earnings include: Carnival Corp.; Paychex Inc.

Sign up for the Lately Newsletter.

What we are t