Economic Calendar: Oct 31 – Nov 4

Monday October 31

China PMI

Japan industrial production, retail sales and consumer confidence

Euro zone real GDP and CPI

Germany retail sales

(10:30 a.m. ET) U.S. Chicago PMI for October.

(10:30 a.m. ET) U.S. Dallas Fed Manufacturing Activity for October.

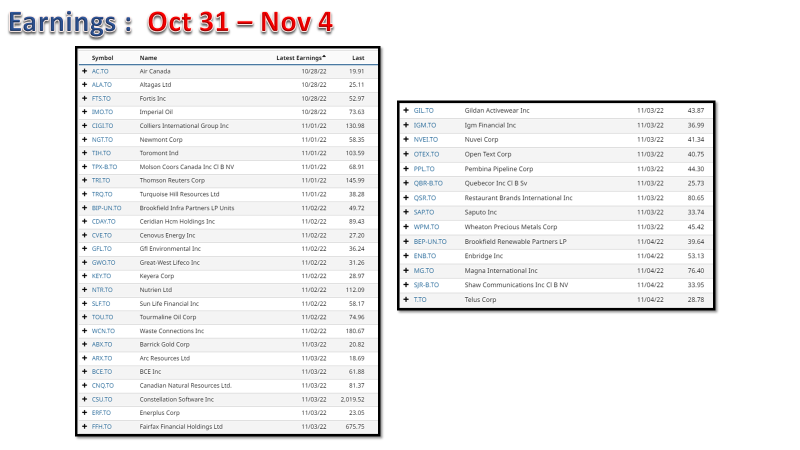

Earnings include: Berkshire Hathaway Inc.; Capital Power Corp.; Capstone Mining Corp.; Cargojet Inc.; Gibson Energy Inc.; Mondelez International Inc.; Stryker Corp.

—

Tuesday November 1

China and Japan manufacturing PMI

(9:30 a.m. ET) Canada’s S&P Global Manufacturing PMI for October.

(9:45 a.m. ET) U.S. S&P Global Manufacturing PMI for October.

(10 a.m. ET) U.S. ISM Manufacturing PMI for October. The Street is expecting a reading of 50.0, down from 50.9 in September.

(10 a.m. ET) U.S. construction spending for September.

(10 a.m. ET) U.S. Job Openings and Labour Turnover Survey for September.

(6:30 p.m. ET) Bank of Canada Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers appear before the Standing Senate Committee on Banking, Commerce and the Economy.

Also: Canadian and U.S. auto sales for October and U.S. Fed meeting begins.

Earnings include: Advanced Micro Devices Inc.; Colliers International Group Inc.; Eli Lilly and Co.; Ero Copper Corp.; International Petroleum Corp.; Ovintiv Inc.; Pfizer Inc.; T-Mobile US Inc.; Thomson Reuters Corp.; Topaz Energy Corp.; Uber Technologies Inc.

—

Wednesday November 2

Euro zone manufacturing PMI

Germany trade surplus and unemployment

(8:15 a.m. ET) U.S. ADP National Employment Report for October.

(2 p.m. ET) U.S. Fed announcement with chair Jerome Powell’s press briefing to follow.

Earnings include: Ballard Power Systems Inc.; Bausch + Lomb Corp.; Brookfield Infrastructure Partners LP; Brookfield Renewable Partners LP; Cenovus Energy Inc.; Ceridian HCM Holding Inc.; CVS Health Corp.; First Capital Reality Inc.; GFL Environmental Holdings Inc.; Great-West Lifeco Inc.; Green Thumb Industries Inc.; Maple Leaf Foods Inc.; MEG Energy Corp.; Nutrien Ltd.; Qualcomm Inc.; Secure Energy Services Inc.; Suncor Energy Inc.; Sun Life Financial Inc.; Waste Connections Inc.

—

Thursday November 3

(8:30 a.m. ET) Canada’s merchandise trade balance for September.

(8:30 a.m. ET) Canadian building permits for September.

(8:30 a.m. ET) U.S. initial jobless claims for week of Oct. 29. Estimate is 222,000, up 5,000 from the previous week.

(8:30 a.m. ET) U.S. productivity for Q3 (preliminary reading). The Street expects an annualized rate rise of 0.2 per cent with unit labour costs up 4.0 per cent.

(8:30 a.m. ET) U.S. goods and services trade deficit for September.

(10 a.m. ET) U.S. factory orders for September. Consensus is a month-over-month rise of 0.3 per cent.

(10 a.m. ET) U.S. ISM Services PMI.

(1:30 p.m. ET) Bank of Canada Deputy Governor Paul Beaudry makes opening remarks in Ottawa at the John Kuszczak Memorial Lecture

Also: Canada’s federal fiscal update

Earnings include: Amgen Inc.; Barrick Gold Corp.; Baytex Energy Corp.; BCE Inc.; Bombardier Inc.; Canadian Natural Resources Ltd.; ConocoPhillips; Enerplus Corp.; Fairfax Financial Holdings Ltd.; Gildan Activewear Inc.; IGM Financial Inc.; Kinaxis Inc.; Labrador Iron Ore Royalty Corp.; Lightspeed Commerce Inc.; Open Text Corp.; Parkland Fuel Corp.; Pembina Pipeline Corp.; Resolute Forest Products Inc.; Restaurant Brands International Inc.; RioCan REIT; Starbucks Corp.; TC Energy Corp.; TransAlta Renewables Inc.; Turquoise Hill Resources Ltd.; Wheaton Precious Metals Corp.

—

Friday November 4

Japan and euro zone PMI

(8:30 a.m. ET) Canadian employment for October. The Street expects an increase of 0.1 per cent, or 10,000 jobs from September with the unemployment rate rising 0.1 per cent to 5.3 per cent.

(8:30 a.m. ET) U.S. nonfarm payrolls for October. The consensus forecast is a rise of 200,000 from September with the unemployment rate increasing 0.1 per cent to 3.6 percent.

(10 a.m. ET) Canada’s Ivey PMI for October.

Earnings include: Alibaba ADR; ARC Resources Ltd.; Canada Goose Holdings Inc.; Duke Energy Corp.; Enbridge Inc.; Magna International Inc.; SNC-Lavalin Group Inc.; Telus International Inc.