Hong Kong’s Hang Seng down around 6% in mixed Asia trade; Japan’s yen weakens despite reports of intervention

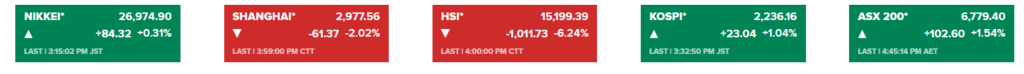

Hong Kong stocks and mainland China markets fell sharply Monday while other major Asia-Pacific markets rose.

Hong Kong’s Hang Seng index spiraled down about 6% to its lowest levels since April 2009, with the Hang Seng Tech index down more than 9%.

Tai Hui, JPMorgan Asset Management’s APAC chief market strategist, said a combination of factors has been driving the Hong Kong market recently, including higher U.S. Treasury yields.

Investors may also have expected policy measures to be announced during the Communist Party of China’s 20th National Congress, which closed over the weekend with President Xi Jinping loyalists tapped to form a core leadership group.

“Since the meeting is mostly about personnel changes, the economic recovery might not come as soon as we have hoped,” Tai told CNBC in an email.

Mainland China markets briefly entered positive territory on better-than-expected economic data before falling again. The Shanghai Composite in mainland China was 2.02% lower at 2,977.56, and the Shenzhen Component lost 2.055% to 10,694.61.

In Australia, the S&P/ASX 200 was 1.54% higher at 6,779.40. The Kospi in South Korea gained 1.04% to 2,236.16, and the Kosdaq added 2.08% to 688.50.

Japan’s Nikkei 225 climbed 0.31% to 26,974.90 and the Topix was up 0.28% to 1,887.19. MSCI’s broadest index of Asia-Pacific shares outside Japan was 1.61% lower.

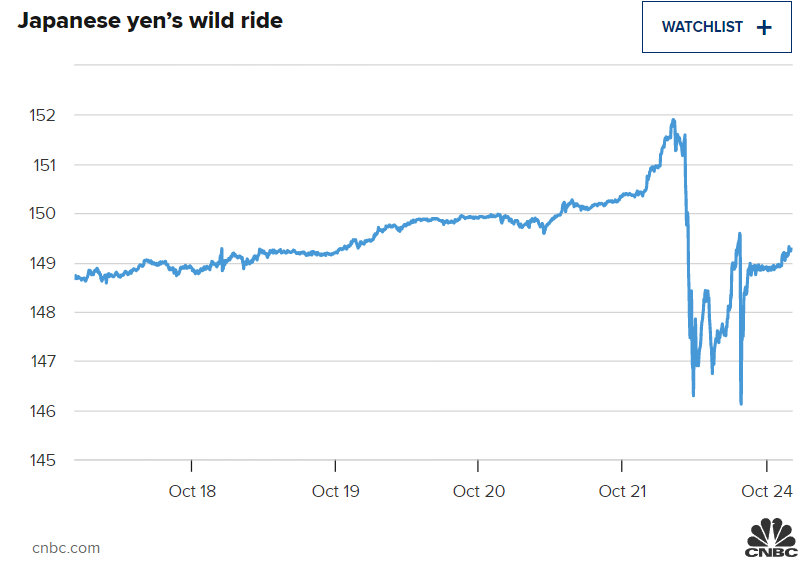

Authorities in Japan reportedly intervened in the forex market on Friday, causing the yen to strengthen sharply. But the currency continued to seesaw. On Monday in Asia, the currency briefly strengthened to 145-levels but was last at 149.09 per dollar.

Japanese yen’s wild ride

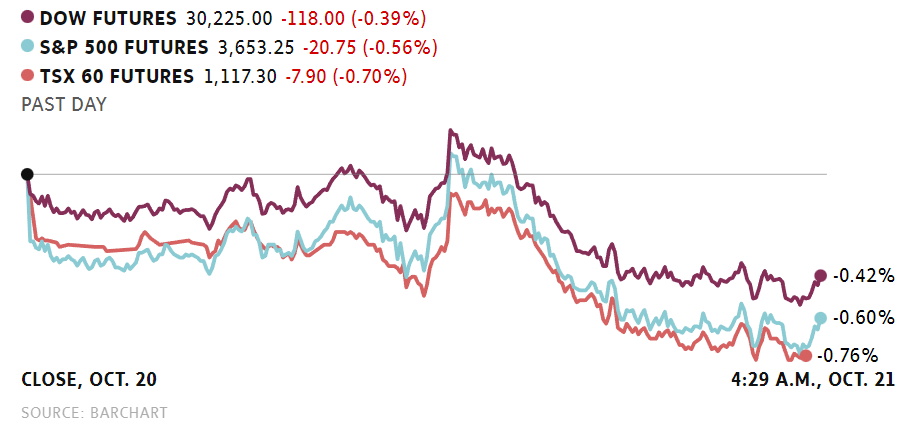

U.S. stocks soared on Friday following a Wall Street Journal report that some Fed officials are concerned about tightening policy too much. On Friday in the U.S., the Dow Jones Industrial Average jumped 748.97 points, or 2.47%, to close at 31,082.56. The S&P 500 added 2.37% to 3,752.75. The Nasdaq Composite climbed 2.31% to 10,859.72.

Singapore, Malaysia and India’s markets are closed for a holiday Monday. Later this week, the Bank of Japan will meet, while Singapore and Australia are expected to release inflation data.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 26974.9 | 84.32 | 0.31 |

| .HSI | Hang Seng Index | *HSI | 15199.39 | -1011.73 | -6.24 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 6779.4 | 102.6 | 1.54 |

| .SSEC | Shanghai | *SHANGHAI | 2977.56 | -61.37 | -2.02 |

| .KS11 | KOSPI Index | *KOSPI | 2236.16 | 23.04 | 1.04 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 6647.37 | -79.53 | -1.18 |

55 MIN AGO

Currency check: Japan’s yen back above 149 per dollar

The U.S. dollar strengthened around 1% against the Japanese yen to 149.20 in Asia’s afternoon after a wild ride for the currency pair.

Authorities in Japan reportedly intervened in the market on Friday, causing the yen to sharply strengthen before weakening again. On Monday morning in Asia, the yen briefly popped to 145-levels.

“The sharp and sudden drop prompted market speculation the Ministry of Finance (MoF) intervened again on Monday following Friday’s intervention,” according to a Commonwealth Bank of Australia note.

The yen then weakened throughout the session before crossing the 149 mark again in the afternoon.

“In line with the usual pattern, we expect the intervention‑induced losses in USD/JPY to be unwound within a few weeks,” the CBA note said.