Author: Consultant

-

Calendar: Aug 15 – Aug 29

Monday August 25

U.K. markets closed

Germany business climate

(10 a.m. ET) U.S. new home sales for July. The Street expects an annualized rate rise of 1.3 per cent.

—

Tuesday August 26

(8:30 a.m. ET) Canada’s manufacturing sales for July.

(8:30 a.m. ET) Canadian wholesale trade for July.

(8:30 a.m. ET) U.S. durable orders for July. Consensus is a month-over-month decline of 4.0 per cent with core orders rise of 0.3 per cent.

(9 a.m. ET) U.S. S&P CoreLogic Case-Shiller Home Price Index (20 city) for June. Consensus is a decline of 0.1 per cent from May but up 1.9 per cent year-over-year.

(9 a.m. ET) U.S. FHFA House Price Index for June. The Street expects a flat reading month-over-month and a gain of 2.7 per cent year-over-year.

(10 a.m. ET) U.S. Conference Board Consumer Confidence Index for August.

(2:30 a.m. ET) Bank of Canada governor Tiff Macklem speaks at the Bank of Mexico’s 100th anniversary seminar.

Earnings include: Bank of Montreal and Bank of Nova Scotia

—

Wednesday August 27

China industrial profits

Germany consumer confidence

Earnings include: CrowdStrike Holdings Inc.; Dollarama Inc.; EQB Inc.; National Bank of Canada; Nvidia Corp.; Royal Bank of Canada

—

Thursday August 28

Euro zone economic and consumer confidence

(8:30 a.m. ET) Canada’s current account balance for Q2.

(8:30 a.m. ET) Canada’s payroll survey: job vacancy rate for June.

(8:30 a.m. ET) U.S. initial jobless claims for week of Aug. 23. Estimate is 229,000, a decline of 6,000 from the previous week.

(8:30 a.m. ET) U.S. real GDP and GDP price index for Q2. Consensus projections are annualized rate increases of 3.1 per cent and 2.0 per cent, respectively.

(10 a.m. ET) U.S. pending home sales for July.

Earnings include: Alibaba ADR; Canadian Imperial Bank of Commerce; Dell Technologies Inc.; Lululemon Athletica Inc.; Toronto-Dominion Bank

—

Friday August 29

Japan jobless rate, industrial production, retail sales and consumer confidence

Germany’s retail sales, CPI and unemployment

ECB’s three-year CPI expectations

(8:30 a.m. ET) Canada’s real GDP for Q2. The Street expects an annualized rate decline of 0.5 per cent with monthly real GDP rising 0.2 per cent from May.

(8:30 a.m. ET) U.S. personal spending and personal income for July. The consensus forecasts are month-over-month gains of 0.5 per cent and 0.4 per cent, respectively.

(8:30 a.m. ET) U.S. core PCE price index for July. Consensus is a gain of 0.3 per cent from June and up 2.9 per cent year-over-year.

(8:30 a.m. ET) U.S. goods trade deficit for July.

(8:30 a.m. ET) U.S. wholesale and retail inventories for July.

(9:45 a.m. ET) U.S. Chicago PMI for August.

(10 a.m. ET) U.S. University of Michigan Consumer Sentiment for August.

Also: Ottawa’s budget balance for June.

Earnings include: BRP Inc.; Laurentian Bank of Canada

-

Cenovus Energy to acquire MEG Energy in $7.9-billion deal

Canadian oil and gas producer Cenovus Energy CVE-T +4.35%increase said on Friday it will buy MEG Energy

N/A in a cash-and-stock deal valued at $7.9-billion, including debt, to create one of the largest oil sands companies in Canada.

The two companies, which will combine MEG’s Christina Lake oil sands operations in Alberta with Cenovus’ neighboring assets, will have a combined oil sands production of over 720,000 barrels per day.

MEG Energy in June rejected a hostile takeover offer from Strathcona Resources, calling the bid inadequate and not in the best interest of its shareholders, and launched a strategic review to explore better alternatives.

James McFarland, chairman of MEG Energy, said on Friday its board and a special committee have “concluded that the proposed transaction with Cenovus represents the best strategic alternative” after considering Strathcona’s unsolicited offer and engaging with multiple parties.

Strathcona Resources did not immediately respond to a Reuters request for comment on whether it was considering an enhanced bid or other options in response to Cenovus’ offer.

Cenovus’ offer of $27.25 per share gives MEG an equity value of about $6.93-billion, according to Reuters calculations. It represents a 27.9-per-cent premium to MEG’s last close before Strathcona launched an unsolicited bid in May.

Under the deal, MEG shareholders will receive 75 per cent of the consideration in cash and 25 per cent in Cenovus shares.

The deal, approved by MEG’s board, is expected to close early in the fourth quarter of 2025.

-

U.S. hikes steel, aluminum tariffs on more than 400 products including appliances, railcars, EV parts

The U.S. Commerce Department on Tuesday said it is hiking steel and aluminum tariffs on more than 400 products including wind turbines, mobile cranes, appliances, bulldozers and other heavy equipment, along with railcars, motorcycles, marine engines, furniture and hundreds of other products.

The department said 407 product categories are being added to the list of “derivative” steel and aluminum products covered by sectoral tariffs, with a 50 per-cent tariff on any steel and aluminum content of these products plus the country rate on the non-steel and non-aluminum content.

Evercore ISI said in a research note the move covers more than 400 product codes representing over US$200-billion in imports last year and estimates it will raise the overall effective tariff rate by around 1 percentage point.

The department is also adding imported parts for automotive exhaust systems and electrical steel needed for electric vehicles to the new tariffs as well as components for buses, air conditioners as well as appliances including refrigerators, freezers and dryers.

A group of foreign automakers had urged the department not to add the parts, saying the U.S. does not have the domestic capacity to handle current demand.

Tesla unsuccessfully asked the Commerce Department to reject a request to add steel products used in electric vehicle motors and wind turbines, saying there was no available U.S. capacity to produce steel for use in the drive unit of EVs.

The new tariffs take effect immediately and also cover compressors and pumps and the metal in imported cosmetics and other personal care packaging like aerosol cans.

“Today’s action expands the reach of the steel and aluminum tariffs and shuts down avenues for circumvention – supporting the continued revitalization of the American steel and aluminum industries,” said Under Secretary of Commerce for Industry and Security Jeffrey Kessler.

Steelmakers including Cleveland Cliffs, Nucor and others had petitioned the administration to expand the tariffs to include additional steel and aluminum auto parts.

-

Canada’s inflation rate slows to 1.7% in July, raising odds of BoC rate cut

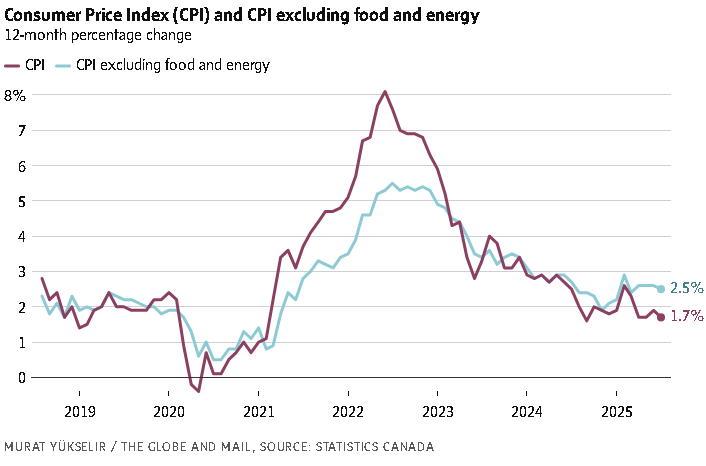

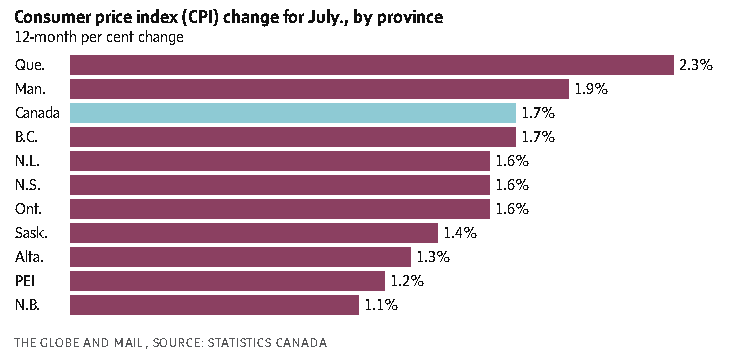

Canada’sinflation rate fell by slightly more than expected in July to 1.7 per cent, which economists say could pave the way for the Bank of Canada to resume cutting interest rates.

Statistics Canada’s consumer price index report on Tuesday said the deceleration from 1.9 per cent in June was led by a decline in gasoline prices, reflecting the removal of the consumer carbon price in the spring.

Meanwhile, grocery prices rose at a faster pace of 3.4 per cent annually. Shelter costs increased by 3 per cent from a year ago, fuelled by a 5.1-per-cent rise in rent and a more modest decline in residential natural gas prices compared with June.

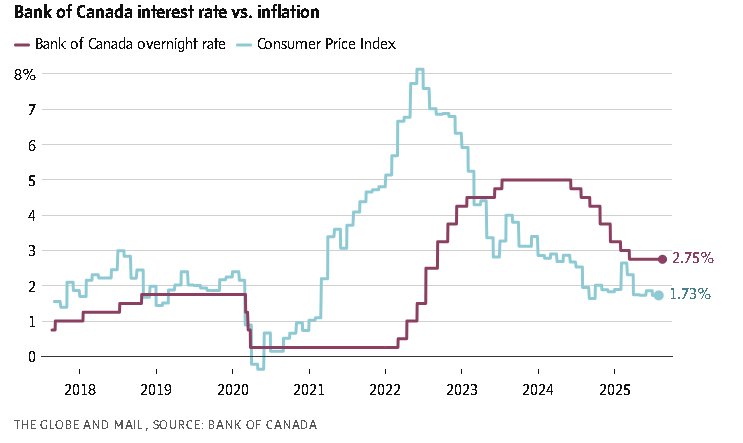

Financial markets reacted to the latest inflation data by increasing the odds of an interest rate cut in September to 36 per cent from 26 per cent the day before, according to data from Bloomberg.

Economists also responded positively to the report, noting that the slowdown could lead to an interest rate cut later this year.

“An easing in inflationary pressures during July means that we have successfully cleared one obstacle on the path towards a potential September interest rate cut,” said CIBC senior economist Andrew Grantham in a client note.

The Bank of Canada has held its key interest rate steady at 2.75 per centduring its last three announcements, noting the economy has held up relatively well despite the impact ofU.S. tariffs. It’s also been somewhat concerned by recent price pressures, which could worsen if the trade conflict escalates. (Businesses would likely pass down higher costs from tariffs on to consumers.)

U.S. tariffs have stalled economic growth in Canada as exports take a hit, but the economy has notgone into freefall.

The USMCA trade pact has allowed a significant chunk of goods to continue crossing the southern border tariff-free, enabling many businesses to avoid the steep levies U.S. President Donald Trump has imposed globally.

Modelling by the Bank of Canada suggests that if the tariff situation doesn’t change by much, Canada will likely avoid a recession and inflation will remain around the 2-per-cent target.

However, Governor Tiff Macklem has left the door open to rate cuts if the economy stalls and inflation remains at bay. Its recent summary of deliberations detailing discussions ahead of its July interest rate decision suggests that members of the governing council are split on whether more relief is needed.

Economists on Bay Street are somewhat more convinced that an interest rate reduction will be needed as slack continues to build in the economy, which is expected to offset some price pressures.

To gauge underlying price pressures, the Bank of Canada keeps a close eye on its preferred core measures of inflation, which did not ease in July, continuing to hover around 3 per cent annually.

However, BMO chief economist Douglas Porter noted that the three-month annualized trend for those measures eased to 2.4 per cent in July.

“If that more recent pace in core is maintained, and the economy remains soft, we believe that will eventually set the stage for BoC cuts,” Mr. Porter said in a client note.

The central bank’s next interest rate announcement is scheduled for Sept. 17.

-

Calendar: Aug 18 – Aug 22

Monday August 18

(8:15 a.m. ET) Canadian housing starts for July. The Street is projecting an annualized rate decline of 4.0 per cent.

(8:30 a.m. ET) Canada’s household and mortgage credit for June.

(8:30 a.m. ET) Canada’s international securities transactions for June.

(10 a.m. ET) U.S. NAHB Housing Market Index for August.

Earnings include: BHP Group Ltd.; Palo Alto Networks Inc.

Tuesday August 19

(8:30 a.m. ET) Canadian CPI for July. Consensus is a month-over-month increase of 0.4 per cent and year-over-year rise of 1.8 per cent.

(8:30 a.m. ET) Canada’s construction investment for June.

(8:30 a.m. ET) U.S. housing starts for July. The Street is projecting an annualized rate decline of 2.4 per cent.

(8:30 a.m. ET) U.S. building permots for July. Consensus is a decline of 0.4 per cent on an annualized rate basis.

Earnings include: Home Depot Inc.

Wednesday August 20

Japan trade balance and core machine orders

Euro zone CPI

(8:30 a.m. ET) Canada’s New Housing Price Index for July. Estimates are a month-over-month decline of 0.2 per cent and 1.5-per-cent drop year-over-year.

(2 p.m. ET) U.S. Fed minutes from July 29-30 meeting are released.

Earnings include: Analog Devices Inc.; Baidu Inc.; Estee Lauder Companies Inc.; Lowe’s Companies Inc.; Target Corp.; TJX Companies Inc.

Thursday August 21

Japan and Europe PMI

(8:30 a.m. ET) Canada’s industrial product and raw materials price indexes for July.

(8:30 a.m. ET) U.S. initial jobless claims for week of Aug. 16. Estimate is 226,000, up 2,000 from the previous week.

(9:45 a.m. ET) U.S. S&P Global PMIs for August.

(10 a.m. ET) U.S. leading indicator for July.

(10 a.m. ET) U.S. existing home sales for July.

Also: Jackson Hole Economic Policy Symposium begins (through Saturday)

Earnings include: Dollar Tree Inc.; Intuit Inc.; Ross Stores Inc.; Walmart Inc.; Workday Inc.

Friday August 22

Japan CPI

Germany GDP

(8:30 a.m. ET) Canadian retail sales for June. The Street expects a month-over-month rise of 1.1 per cent.

(10 a.m. ET) U.S. Fed chair Jerome Powell speaks on the Economic Outlook and Framework Review at the Jackson Hole Symposium.

(10:30 a.m. ET) Bank of Canada Senior Loan Officer Survey for Q2.

Earnings include: Paladin Energy Ltd.

-

What are the sticking points of contention between Albert and the Cd. Govt’s economic policies

The main sticking points of contention between Alberta and the Canadian federal government’s economic policies in 2025 revolve around these key issues:

1. Trade and Tariff Policy

- Both Alberta and the federal government are grappling with the fallout of a Canada-U.S. trade dispute. The high risk of increased tariffs (10% on energy products and 15% on other goods) imposed by the U.S., and subsequent Canadian retaliation, are expected to dampen Alberta’s economic growth and create uncertainty for provincial revenues.

- Alberta has criticized the federal approach to both U.S. trade negotiations and the retaliatory tariffs, arguing they disproportionately hurt Alberta’s energy sector, which is critical to the province’s economy.

2. Personal Income Taxes and Fiscal Approach

- Alberta has introduced significant personal income tax cuts (a new 8% bracket for income under $60,000), fulfilling a provincial promise to ease the cost of living and provide relief to households. The federal government, however, has not matched these tax cuts and often emphasizes more cautious fiscal stimulus and redistribution spending.

- Alberta’s tax cut has led to rising provincial deficits (projected at $5.2 billion for 2025/26 and totaling $9.6 billion over 3 years), clashing with Ottawa’s pressure for fiscal prudence and sustainable spending.

3. Spending Priorities & Social Investments

- Alberta’s budget has drawn criticism for large increases in medical spending and relatively little investment in affordable housing, childcare, and poverty reduction. The federal government often seeks greater spending on these areas, arguing for more balanced, inclusive economic policies.

- There are complaints that Alberta’s policies favor older residents (through healthcare), neglecting the needs of younger citizens for housing and future prosperity.

4. Climate Policy

- Alberta opposes the federal carbon pricing scheme and maintains more tolerant policies toward emissions within the province. There is ongoing resistance to federal environment and climate regulations, with Alberta favoring the interests of its energy sector over federal standards.

- Alberta feels federal climate initiatives undermine provincial competitiveness and job stability, particularly in oil and gas.

5. Population Growth & Immigration

- Alberta forecasts slower population growth due to the 2025-2027 Federal Immigration Levels Plan, which reduces net international migration, and believes this will hurt labor market and economic growth locally.

- Alberta wants more autonomy and flexibility in immigration policy to support its economy’s needs.

In summary:

The biggest sticking points are:- Handling of U.S. trade tensions and tariffs.

- Divergence on tax policy and fiscal deficits.

- Disagreements over social spending priorities and investment in younger generations.

- Conflicts over climate action and energy sector regulation.

- Differences in approach to immigration and population growth planning.

These ongoing fractures reflect Alberta’s preference for lower taxes, looser regulatory controls, and sector-specific support (especially oil/gas), versus the federal government’s emphasis on national standards, climate action, fiscal discipline, and broader redistribution.

-

Evidence Supporting Carney’s Role in Climate Advocacy

1. United Nations Special Envoy for Climate Action and Finance

In December 2019, Mark Carney was appointed by UN Secretary-General António Guterres as the UN Special Envoy on Climate Action and Finance—a role central to galvanizing financial systems to support climate goals. Bank of England+15Wikipedia+15TIME+15

2. Founder of Glasgow Financial Alliance for Net Zero (GFANZ)

At COP26 in November 2021, Carney launched the GFANZ, a major global coalition of banks and asset managers committed to financing the transition to net-zero emissions. World Economic Forum+4Wikipedia+4The Guardian+4

3. Leading Advocate for Climate-Smart Finance

Carney frequently emphasized the need for private sector involvement in climate action:

- In 2020, he proclaimed that the green transition is “the greatest commercial opportunity of our time.” Bank of England+15Wikipedia+15TIME+15

- In March 2021, he noted that Canada is poised to benefit economically from moving toward a sustainable, low-carbon economy. Wikipedia+1

4. Putting Climate at the Heart of Financial Discourse

Even during his time as Bank of England Governor, Carney was deeply engaged in framing climate change as a financial stability issue:

- He warned companies failing to address climate risks could go bankrupt, estimating up to $20 trillion in assets could be at risk. Counterfire+15The Guardian+15World Economic Forum+15

- In 2020, he publicly sided with Greta Thunberg over Trump on climate urgency, recognizing the danger of depleting the carbon budget and the importance of scientific insight. The Guardian

5. “Climate Radical” with Scientific Conviction

Carney is recognized not just for rhetoric but for bold, data-driven positions:

- Analysts note his belief that most remaining fossil fuel reserves must remain unburned to prevent catastrophic overheating—highlighting the radical political and economic shifts implied. Covering Climate Now

6. Pragmatic Eco-Leadership as Prime Minister

Post‑2025 election, although climate wasn’t central to the campaign, Carney’s climate credentials remain strong. Observers expect his administration to:

- Deploy tax incentives, transition bonds, and border carbon taxes to advance environmental progress. TIME

Summary Table

Role / Action Impact on Climate Advocacy UN Special Envoy (2019–2025) Championing alignment of global finance with climate goals GFANZ Founder (2021) Leading coalition to mobilize banking sector toward net-zero emissions Public Warnings as Governor Highlighted climate risk as a systemic threat to financial stability Support for Greta Thunberg (2020) Bridged intergenerational climate advocacy and scientific urgency Scientific Stance on Fossil Fuels Called for most fossil reserves to stay unburned to prevent global overheating Eco-Policy Leadership as PM Advocating economic tools for climate action, even post-campaign shift

Mark Carney clearly blends high-impact global climate leadership with bold economic reasoning—positions that firmly establish him as a climate defender both in word and in action.

-

Imperial Oil (IMO.TO) shares have increased in recent weeks due to several important factors:

- Record Production & Upstream Strength: Q2 2025 saw Imperial achieve its highest second-quarter upstream production in 30+ years, driven by better reliability and mine productivity at its Kearl asset (275,000 gross barrels/day). This strong operational performance is expected to boost results further in the latter half of 2025 as new projects like Leming SAGD ramp up.

- Aggressive Shareholder Returns: The company returned C$367 million to shareholders via dividends and has ramped up its share repurchase program, with plans to complete it by year-end. Capital returns are a key draw for investors and demonstrate management’s confidence in ongoing strong cash generation.

- Strategic Growth and Diversification: Imperial completed Canada’s largest renewable diesel facility at its Strathcona refinery in July 2025, aligning with lower-carbon energy policies and diversifying earnings. Further growth is expected from ongoing upgrades and expansions at major assets.

- Improved Market Access: Expansion of the Trans Mountain pipeline has enabled higher petroleum product sales, increasing Imperial’s downstream margins and market reach.

- Strong Balance Sheet and Cash Flow: Imperial maintains low debt and robust cash flows, giving it financial flexibility to withstand commodity price swings and fund growth. Q1 and Q2 reports highlighted rising profits, improved cash flow, and ongoing dividend increases (30 consecutive years of dividend growth).

- Positive Analyst Sentiment & Technicals: Industry experts note Imperial’s breakout to new highs, premium valuation, and the stock’s resilience in a consolidating oil sector. With a long reserve life (25 years), steady buybacks, and quality management, investors see further upside if oil prices remain firm.

In summary, Imperial’s share price climb is fueled by record production, strong shareholder returns, growth in renewables, expanded market access, financial strength, and support from analysts and technical traders.