Celestica Inc. CLS-T +16.92%increase continued in the second quarter to benefit from surging demand from tech giants engaged in a global arms race to build giant artificial intelligence-driven data centres, surpassing heightened market expectations.

The Toronto-based global manufacturing giant reported Monday after the market close that it generated US$2.89-billion of revenue in the quarter ended June 30, up 21 per cent from the same period a year earlier. It also reported adjusted earnings of US$1.39 a share, up 54 per cent, and net earnings of US$1.82 a share, up 128 per cent.

Celestica’s U.S.-listed shares jumped more than 10 per cent in after-market trading Monday after the stock closed at an all-time high of $238.07 on the Toronto Stock Exchange. The stock has appreciated by nearly 80 per cent this year and is up more than 15-fold since the end of 2022, giving the company a market capitalization of nearly $27-billion. That makes Celestica the fourth-most valuable technology company on the Toronto Stock Exchange.

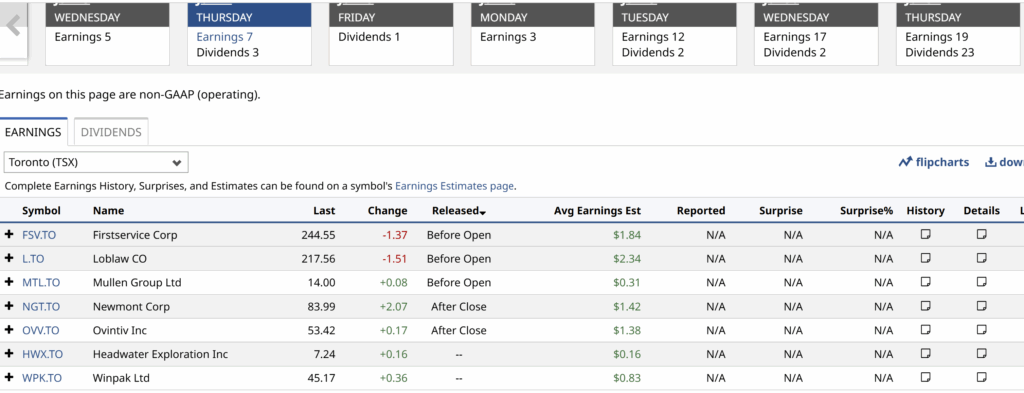

Celestica Inc Sv

238.07+105.41 (79.46%)

Year to date

Dec. 31, 2024

132.66

July 28, 2025

238.07

SOURCE: BARCHART

Celestica came into the quarter expected to not only beat its own increased projections from April, but also recent analyst forecasts after exceeding their estimates for revenue and adjusted earnings in each of the past four quarters. It did so.

Revenues were about $200-million above the upper end of the company’s forecast revenue and analyst estimates, while its adjusted operating margin of 7.4 per cent was 20 basis points above its forecast. The company also raised its guidance for 2025, forecasting revenue of US$11.55-billion (up US$700-million from its increased forecast in April) and adjusted earnings per share of US$5.50, up from its prior US$5 forecast.

Analysts had widely expected Celestica to increase its forecast after doing so last quarter,and three times in each of the past two years. In addition, rivals Accton Technology Corp., Broadcom Inc. AVGO-Q +1.72%increase and Jabil Inc. JBL-N +3.10%increase recently reported financial results above expectations,and AI chip giant Nvidia Corp.

N/A recently surpassed US$4-trillion in stock market value.

Celestica, which supplies equipment to data centres and server farms that provide the computing power for AI models, has been on a tear since 2022, when OpenAI launched ChatGPT and kicked off the generative AI revolution.

CEO of Canada’s Celestica sells $130-million of shares, cashing in on Nvidia-style gains during AI boom

The Canadian company is a key supplier to tech giant “hyperscalers” including Google, Meta Platforms and Amazon.com Inc. They have heavily upgraded computing capacity for AI development and are accelerating plans to do so: Google said last week it would make US$85-billion of capital expenditures this year, US$10-billion higher than previously forecast. Revenue from the Celestica segment which supplies the AI boom, increased by 28 per cent in the quarter to US$2.07-billion, accounting for 71.6 per cent of total company revenues.

“Celestica is benefiting from AI-driven data center expansion through its storage and networking produces, as well as servers for AI applications,” RBC Capital Markets analyst Paul Treiber said in a note to clients last week.

Celestica provides computing modules, network switches and data storage capacity for server farms, none of which is a straightforward manufacturing job. It incorporates custom silicon and has proprietary thermal and power management designs to help companies manage the extreme heat and electricity needed to run data centres.

Celestica was briefly a stock market darling a quarter century ago, after the former IBM division was purchased by Onex Corp. ONEX-T -0.22%decrease and spun out into a public company as dot-com mania heated up. (Onex sold out of its position in 2023, before most of the stock’s current run). Its stock soared as the company supplied fibre-optic cables and other equipment used to build out the internet.

But Celestica shares crashed amid the dot-com bust and remained in investor purgatory for two decades.

Chief executive Rob Mionis arrived in 2015 after the company had experienced years of losses, job cuts and shareholder lawsuits. The American-born private equity and aerospace industry veteran shifted Celestica’s orientation, moving it away from manufacturing low-margin products and competing on price to building more complex equipment that required engineering expertise. It improved its mix of customer segments with higher margin products in aerospace and defence, renewable energy, electric vehicle chargers and medical devices.

But the company’s coup was landing a lead position servicing tech giants as they built out data centres. Those relationships, forged before ChatGPT’s arrival, put the company in position to take off with the arrival of the generative AI wave that is now rapidly transforming the global economy,Mr. Mionissaid in a 2023 interview.

Now, the company’s shares trade above its peers and at the high end of their 10-year range, and it is likely to maintain its premium valuation, Mr. Treiber wrote last week.