Canada’s economy contracted in the second quarter by a much larger degree than anticipated on an annualized basis as U.S. tariffs squeezed exports, but higher household and government spending cushioned some of the impact, data showed on Friday.

The GDP for the quarter that ended June 30 decelerated by 1.6 per cent on an annualized basis from a downwardly revised growth of 2.0 per cent posted in the first quarter, Statistics Canada said, taking the total annualized growth in the first six months of the year to 0.4 per cent.

This was the first quarterly contraction in seven quarters.

How today’s surprisingly weak GDP report has shifted market and economist views for future BoC rate cuts

Canada’s annual job growth barely above zero in June, payroll survey shows

U.S. trade tensions drag down already weak business creation in Canada

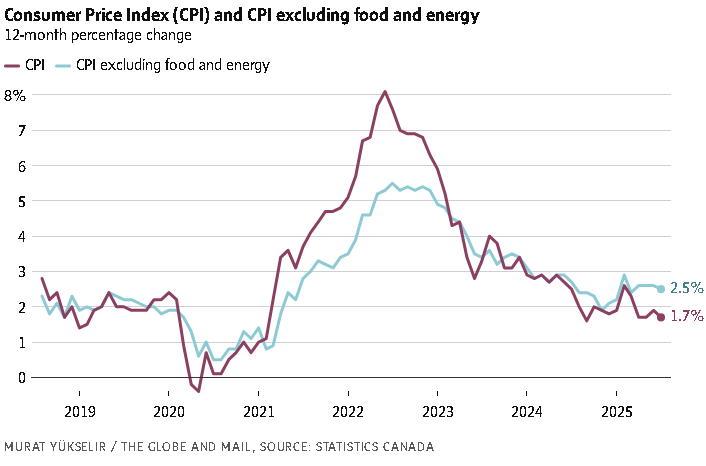

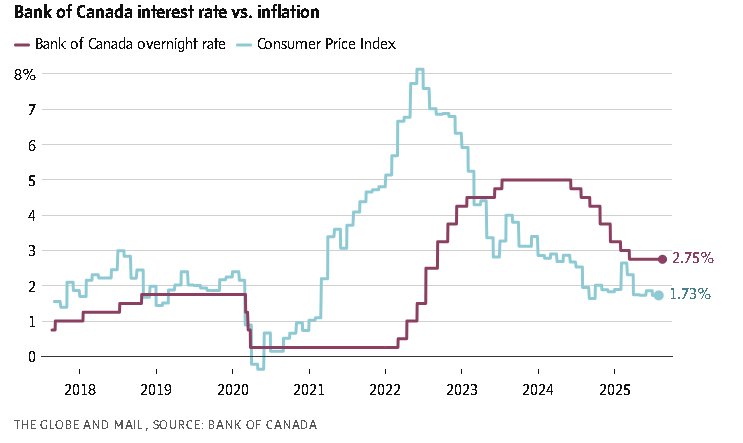

A larger-than-expected deceleration in growth could boost chances of rate cut by the Bank of Canada in September. The central bank has kept rates steady at 2.75 per cent at its last three meetings.

Money markets increased their bets of a rate cut on September 17 to 48 per cent after the GDP data was released from 40 per cent before.

Statscan said the economy contracted by 0.1 per cent in June, mainly led by a decline in output from goods-producing industries, which accounts for a quarter of the country’s GDP.

The quarterly GDP is calculated based on income and expenditure while the monthly GDP is derived from industrial output.

This is the third month in a row that the GDP, based on industry output declined and was the first time in three years that the economy contracted for three consecutive months.

Analysts polled by Reuters had forecast second quarter GDP to contract by 0.6 per cent and the June monthly GDP to expand by 0.1 per cent.

An advance estimate for July showed the economy could likely grow by 0.1 per cent on a month-on-month basis, signalling that the third quarter might not be as bad as the previous one.

The Canadian dollar traded down 0.17 per cent to 1.3771 to the U.S. dollar, or 72.62 U.S. cents. Yields on the two-year government bonds dropped further after the data fell by 2.8 basis points to 2.664 per cent.

Exports, mainly responsible for sinking the economy in the second quarter, declined 7.5 per cent in the second quarter, the statistics agency said, adding this was the biggest drop in five years.

Business investment in machinery and equipment also contracted for the first time since the pandemic, with investments falling 0.6 per cent in Q2.

However, some silver lining in the second quarter came from a 3.5 per cent growth in the final domestic demand, an indicator of the health of the domestic economy.

This was mainly boosted by household final consumption expenditure which jumped by 4.5 per cent on an annualized basis, residential investments which rose 6.3 per cent and government final consumption expenditure which surged by 5.1 per cent, Statscan noted.