A lead representative of Canada’s automotive parts sector is warning that U.S. President Donald Trump’s latest tariff plans would decimate vehicle production on both sides of the border, causing business to dry up for hundreds of supplier companies.

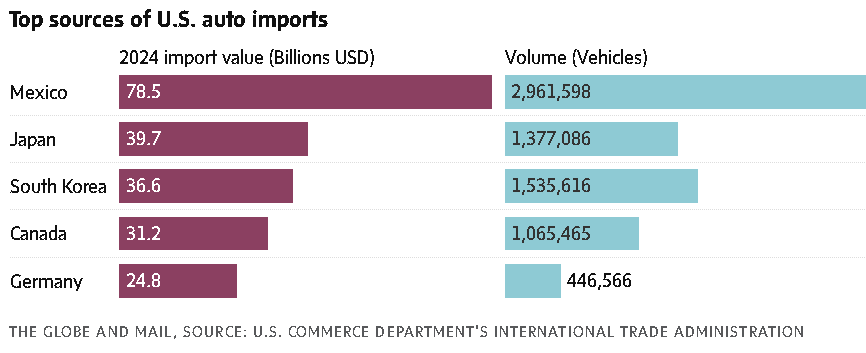

On Wednesday, Mr. Trump said automobiles and auto parts imported to the U.S. will face 25-per-cent tariffs. Vehicles imported under the USMCA will be taxed at the same amount, and the rate will be calculated based on their non-U.S. content. Auto parts under the trade agreement will face tariffs at a later date, also calculated based on non-U.S. content.

“He may just be crazy enough to take the entire industry over the ledge,” said Flavio Volpe, the president of the Automotive Parts Manufacturers Association, in an interview Thursday.

Even before the announcement, Mr. Volpe’s members were struggling with a series of punitive trade policies introduced or threatened by Mr. Trump this winter. That particularly applied to companies hit by tariffs imposed on Canadian steel and aluminum exports.

But the newest measure, Mr. Volpe suggested, would affect all suppliers even if they weren’t directly targeted and would weaken the North American industry at large – a concern echoed by representatives on both sides of the border.

“This is all stacking up to not bode well,” said Glenn Stevens, executive director of MichAuto, Michigan’s automobile industry association.

Canada’s auto sector could face layoffs, shutdowns due to Trump tariffs, say industry experts

The share price for major Canadian parts manufacturer Magna International Inc. MG-T -2.14%decrease dropped by 6.9 per cent on Thursday.

The concern from industry is not that auto makers would quickly shift from Canadian to U.S. suppliers, which seems to be Mr. Trump’s aim in threatening tariffs on imported parts. This is not feasible because such relationships – often involving products customized to the auto makers’ needs – are too locked in for that.

Because auto manufacturing in North America is a “very inelastic industry,” Mr. Volpe said, the tariffs on parts would make vehicle assembly so expensive that auto makers would have to slow or even stop their operations, and cancel or postpone orders.

This wheel is, however, already in motion, and began as soon as Mr. Trump threatened North American free trade.

Jahn Engineering is a Canadian company based in Oldcastle, Ont., that sends orders to auto manufacturers across the border. They haven’t received an order in around six months. They typically receive between five and 10 new contracts per month.

The company is likely not subject to the latest U.S. tariffs on vehicles and parts. It builds the equipment used to manufacture parts and – based on the White House release Wednesday night – automobile and auto parts will be targeted by the new tariffs.

Unifor president Lana Payne calls for job protections for auto workers in the wake of U.S. President Donald Trump’s latest tariff announcement, which imposes 25 per cent tariffs on auto imports. Payne said any company that wants to sell vehicles in Canada should have a footprint in the country or face another set of rules.

The Canadian Press

However, facing uncertainty from Mr. Trump’s on-and-off-again trade war, major auto manufacturers have delayed manufacturing new car models, said Louis Jahn, the company’s chief executive officer.

Overall, around 75 per cent of the projects for new models are on hold and have been since before Mr. Trump’s inauguration, said Mr. Jahn, who is also president of the Canadian Tooling & Machining Association. Orders are down 80 per cent for the Canadian sector, he added.

Manufacturing new models isn’t the only disruption impacting the production cycles of major auto manufacturers. The latest tariffs build on layers of complexity that make it particularly difficult for companies to make informed choices, Mr. Stevens said.

The auto sector is also contending with problems such as steel and aluminum tariffs, retaliatory tariffs from other nations and Mr. Trump’s pull back on electric vehicles.

For these reasons, auto manufacturers have also delayed capital expenses and cut back on their work force, Mr. Stevens said, adding that it is hard to predict how the next few weeks will play out but uncertainty is not good for business.

“I fear we’re going to see more paralysis as this shakes out,” he said.

Mr. Trump, by undermining the interconnected nature of North America’s auto industry and threatening the fiscal feasibility of every company along the value chain, could drive higher prices and lower selection for consumers. It will make the sector less competitive precisely when other industries across the globe – notably China – are aggressively growing and expanding.

“If anything, this weakens us,” Mr. Stevens said, adding that “it will be very disruptive to an industry that took decades to develop.”