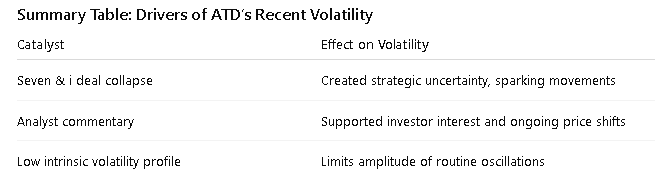

Recent volatility in Alimentation Couche-Tard (ATD.TO) has been driven by several key factors:

- Withdrawal of the US$46 billion Seven & i Holdings acquisition bid: The company spent months pursuing this major Japanese retailer, but withdrew its offer last month due to a lack of constructive engagement. The announcement led to a short-term stock bounce (up 2.4% immediately after, 8.3% after deal withdrawal), but the prolonged uncertainty weighed on the stock for much of the year.

- Broader economic pressures: The stock’s weakness has also been influenced by overall market concerns, including fears of recession in Canada, economic challenges globally, and ongoing threats such as Trump’s tariffs.

- Recent earnings and fuel market impacts: Quarterly earnings showed a 7.5% YoY revenue decline, mainly due to a 10.2% drop in road fuel revenues and 26.2% decline in other segments, even though gross profits grew thanks to higher fuel margins. Increased operating and financial expenses led to a drop in net income. Weather events, like severe winter storms, also hurt fuel volumes in the U.S. earlier in the year.

- Resumption of share buybacks: After ending the acquisition attempt, Couche-Tard announced a major share buyback program to support the share price, which added another layer of recent price movement.

In summary, volatility stemmed from acquisition activity and uncertainty, earnings pressure from fuel sales, macroeconomic concerns, and the company’s strategic responses to these challenges.

Leave a Reply

You must be logged in to post a comment.