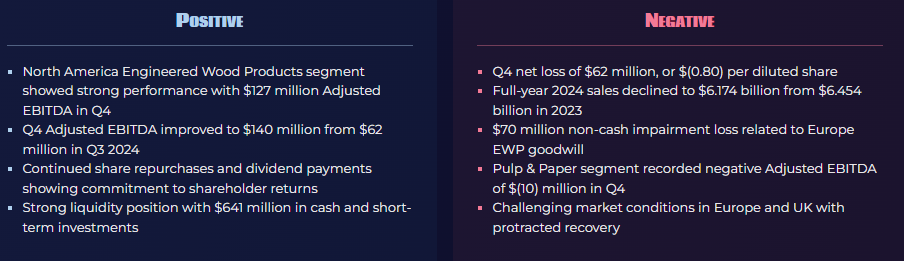

West Fraser Timber (WFG) reported Q4 2024 results with sales of $1.405 billion and a loss of $62 million, or $(0.80) per diluted share. The company’s Q4 Adjusted EBITDA was $140 million, representing 10% of sales. For the full year 2024, sales reached $6.174 billion with a loss of $5 million.

Key segment performance in Q4 included Lumber Adjusted EBITDA of $21 million, North America Engineered Wood Products at $127 million, and Europe EWP at $2 million, while Pulp & Paper recorded $(10) million. The company repurchased 311,523 shares for $27 million in Q4 and paid $26 million in dividends.

The company noted continued resilience in NA Engineered Wood Products business, supported by solid new home construction demand. However, high mortgage rates remain an affordability challenge, and potential U.S. tariffs on Canadian exports add uncertainty. For 2025, capital expenditures are expected to be $400-450 million.

West Fraser’s Q4 2024 results reflect the company’s resilience amid challenging market conditions, with the North America Engineered Wood Products segment delivering robust $127 million in Adjusted EBITDA, offsetting weakness in other segments. The 10% EBITDA margin on $1.405 billion in sales demonstrates maintained operational efficiency despite market headwinds.

The balance sheet remains exceptionally strong, with $641 million in cash even after retiring $300 million in senior notes. This financial flexibility positions the company well for both defensive and opportunistic moves in 2025. The continued share repurchases and steady dividend payments signal management’s confidence in sustainable cash flow generation.

Looking ahead to 2025, the operational guidance suggests cautious optimism. The targeted SPF shipments of 2.7-3.0 billion board feet and SYP shipments of 2.5-2.8 billion board feet indicate expectations of stable demand, though potential U.S. tariffs on Canadian exports remain a key risk factor. The $400-450 million projected capital expenditure demonstrates commitment to strategic mill modernization while maintaining financial discipline.

The $70 million non-cash impairment of Europe EWP goodwill reflects ongoing challenges in European markets, but the segment’s gradual recovery potential remains intact as interest rates begin to decline and OSB continues to gain market share from plywood. The company’s portfolio optimization strategy, shifting production from higher-cost to lower-cost mills, shows promise in improving overall cost position and operational efficiency.

Leave a Reply

You must be logged in to post a comment.