Monday June 2

China PMI

Japan and Euro zone manufacturing PMI

(9:30 a.m. ET) Canada’s S&P global manufacturing PMI for May.

(9:45 a.m. ET) U.S. S&P global manufacturing PMI for May.

(10 a.m. ET) U.S. ISM manufacturing PMI for May.

(10 a.m. ET) U.S. construction spending for April.

(1 p.m. ET) U.S. Fed chair Jerome Powell gives opening remarks at International Finance Divisions conference.

Also: U.S. and Canadian auto sales for May

Earnings include: Campbell Soup Co.

—

Tuesday June 3

Euro zone CPI and jobless rate

(10 a.m. ET) U.S. factory orders for April.

(10 a.m. ET) U.S. Job Openings and Labor Turnover Survey for April.

Earnings include: CrowdStrike Holdings Inc.; Dollar General Corp.; Ferguson Enterprises; Hewlett Packard Enterprise Co.; Snowline Gold Corp.

—

Wednesday June 4

Japan and euro zone services and composite PMI

(8:15 a.m. ET) U.S. ADP National Employment Report for May.

(8:30 a.m. ET) Canadian labour productivity for Q1.

(9:30 a.m. ET) Canada’s S&P Global Services PMI for May.

(9:45 a.m. ET) Bank of Canada policy announcement with press conference to follow.

(9:45 a.m. ET) U.S. S&P Global Services/Composite PMI for May.

(10 a.m. ET) U.S. ISM Services PMI for May.

(2 p.m. ET) U.S Beige Book is released.

Earnings include: Descartes Systems Group Inc.; Dollar Tree Inc.; GameStop Corp.; Northwest Co. Inc.; Transcontinental Inc.

—

Thursday June 5

ECB monetary policy meeting

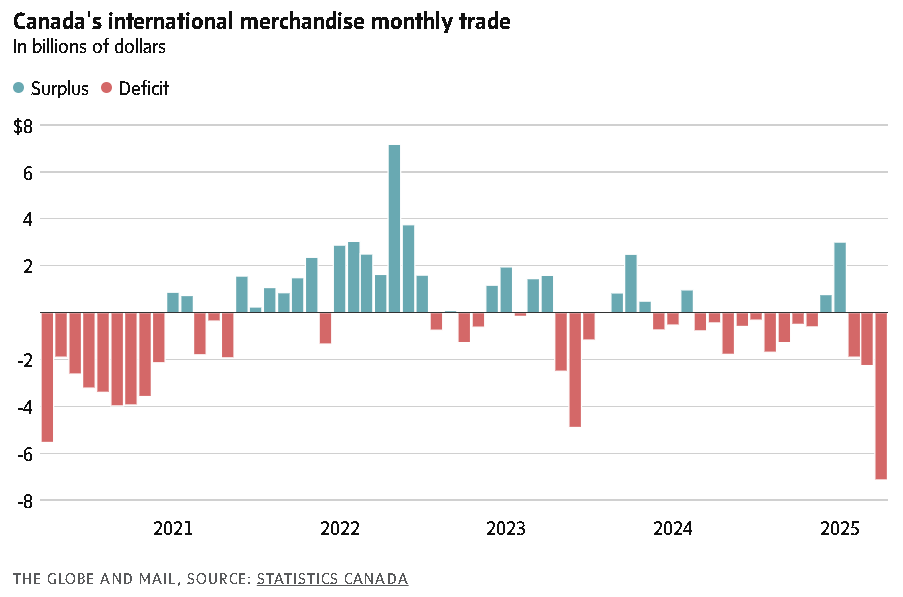

(8:30 a.m. ET) Canada’s merchandise trade balance for April.

(8:30 a.m. ET) U.S. initial jobless claims for week of May 31. Estimate is 236,000, down 4,000 from the previous week.

(8:30 a.m. ET) U.S. productivity for Q1. The Street expects an annualized rate decline of 0.7 per cent with unit labour costs rising 5.7 per cent.

(8:30 a.m. ET) U.S. goods and services trade deficit for April.

(10 a.m. ET) U.S. global supply chain pressure index for May.

Earnings include: Broadcom Inc.; Enghouse Systems Ltd.; Lululemon Athletica Inc.; Rupert Resources Ltd.; Saputo Inc.

—

Friday June 6

China foreign reserves

Japan household spending

Euro zone retail sales and real GDP

Germany industrial production and trade surplus

(8:30 a.m. ET) Canadian employment for May. The Street expects a drop of 0.1 per cent, or 17,500 jobs, with the unemployment rate rising to 7.0 per cent from 6.9 per cent and average hourly wages rising 3.2 per cent year-over-year.

(8:30 a.m. ET) U.S. nonfarm payrolls for May. Consensus is a gain of 130,000 jobs with the unemployment rate remaining 4.2 per cent and average hourly wages up 0.3 per cent sequentially and 3.7 per cent from the same period a year ago.

(3 p.m. ET) U.S. consumer credit for April.