Monday February 10

China CPI, PPI, aggregate yuan financing and new yuan loans

Japan bank lending

(10:30 a.m. ET) Bank of Canada’s Market Participants Survey for Q4.

Earnings include: CT REIT; Lowes Corp.; McDonald’s Corp.; PrairieSky Royalty Ltd.

Tuesday February 11

Japanese markets closed

(6 a.m. ET) U.S. NFIB Small Business Economic Trends Survey for January.

(8:30 a.m. ET) Canada’s building permits for December. Estimate is a month-over-month rise of 2.0 per cent.

(10 a.m. ET) U.S. Fed chair Jerome Powell testifies before Senate Committee on Banking, Housing and Urban Affairs.

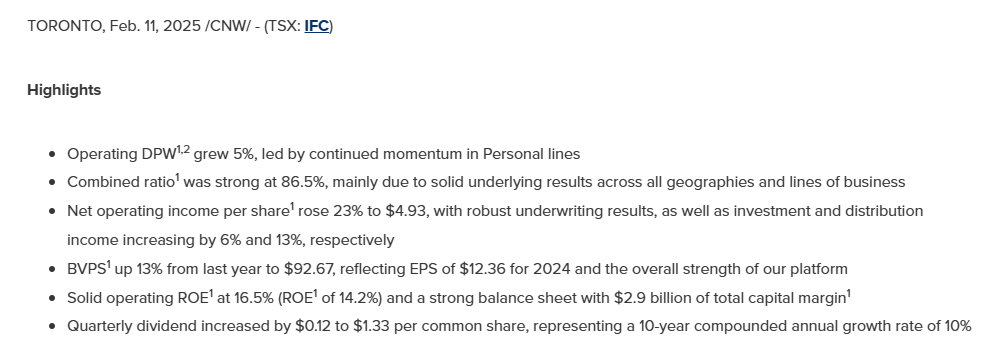

Earnings include: Coca-Cola Co.; First Capital Realty Inc.; First Quantum Minerals Ltd.; Gilead Sciences Inc.; Intact Financial Corp.; International Petroleum Corp.; Marriott International Inc.; Shopify Inc.; S&P Global Inc.; Toromont Industries Ltd.

Wednesday February 12

Japan machine tool orders

(8:30 a.m. ET) U.S. CPI (and revisions) for January. The Street is projecting a rise of 0.3 per cent from December and up 2.9 per cent year-over-year.

(10 a.m. ET) U.S. Fed chair Jerome Powell testifies to the House Financial Services Committee.

(1:30 p.m. ET) Bank of Canada’s summary of deliberations for the Jan. 29 decision.

(2 p.m. ET) U.S. budget balance for January.

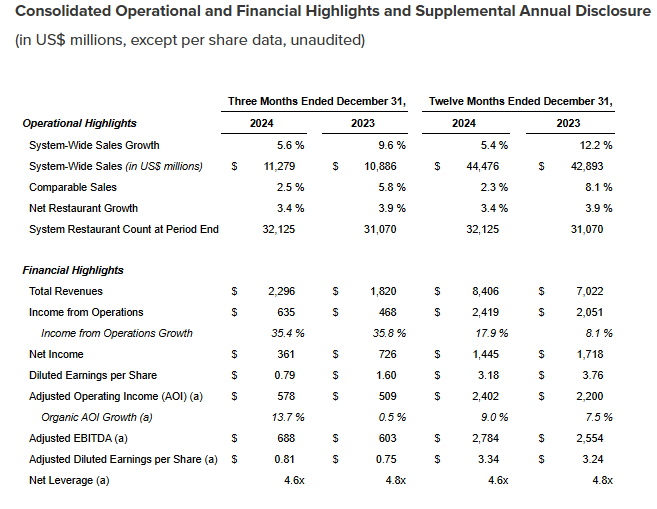

Earnings include: Alibaba ADR; Barrick Gold Corp.; Cenovus Energy Inc.; Choice Properties REIT; Cisco Systems Inc.; H&R REIT; IA Financial Corp. Inc.; Kinross Gold Corp.; Restaurant Brands International Inc.; Robinhood Markets Inc.; Russel Metals Inc.; SmartCentres REIT; Sun Life Financial Inc.; Waste Connections Inc.; West Fraser Timber Co. Ltd.

Thursday February 13

ECB economic bulletin is released

Euro zone industrial production

Germany CPI

U.K. GDP, industrial production and trade deficit

(8:30 a.m. ET) Canada’s construction investment for December.

(8:30 a.m. ET) U.S. initial jobless claims for week of Feb. 8. Estimate is 216,000, down 3,000 from the previous week.

(8:30 a.m. ET) U.S. PPI final demand (and revisions) for January. The Street is projecting a rise of 0.2 per cent from December and 3.0 per cent year-over-year.

Earnings include: Agnico Eagle Mines Ltd.; Airbnb Inc.; Applied Materials Inc.; Brookfield Corp.; CAP REIT; Canadian Tire Corp. Ltd.; Coinbase Global Inc.; Deere & Co.; Definity Financial Corp.; Dundee Precious Metals Inc.; Fairfax Financial Holdings Ltd.; Goeasy Ltd.; Keyera Corp.; Telus Corp.

Friday February 14

Euro zone real GDP

(8:30 a.m. ET) Canada’s manufacturing sales and new orders for December. The Street is projecting month-over-month increases of 1.0 per cent and 1.1 per cent, respectively.

(8:30 a.m. ET) Canadian wholesale trade for December. Estimate is a month-over-month rise of 0.5 per cent.

(8:30 a.m. ET) Canadian new motor vehicle sales for December. Estimate is a year-over-year increase of 6.5 per cent.

(8:30 a.m. ET) U.S. retail sales for January. The Street expects a flat reading month-over-month.

(8:30 a.m. ET) U.S. import prices for January. Consensus is a rise of 0.4 per cent from December an up 1.9 per cent year-over-year.

(9:15 a.m. ET) U.S. industrial production and capacity utilization for January.

(10 a.m. ET) U.S. business inventories for December. Consensus is a month-over-month gain of 0.1 per cent.

(10:30 a.m. ET) Bank of Canaa Senior Loan Officer Survey for Q4.

Earnings include: Air Canada; Enbridge Inc.; Fortis Inc.; Magna International Inc.; TC Energy Corp.