Canada’s annual inflation rate accelerated for the second month in a row, increasing pressure on the Bank of Canada to raise interest rates again shortly after it announced its second pause to monetary policy tightening this year.

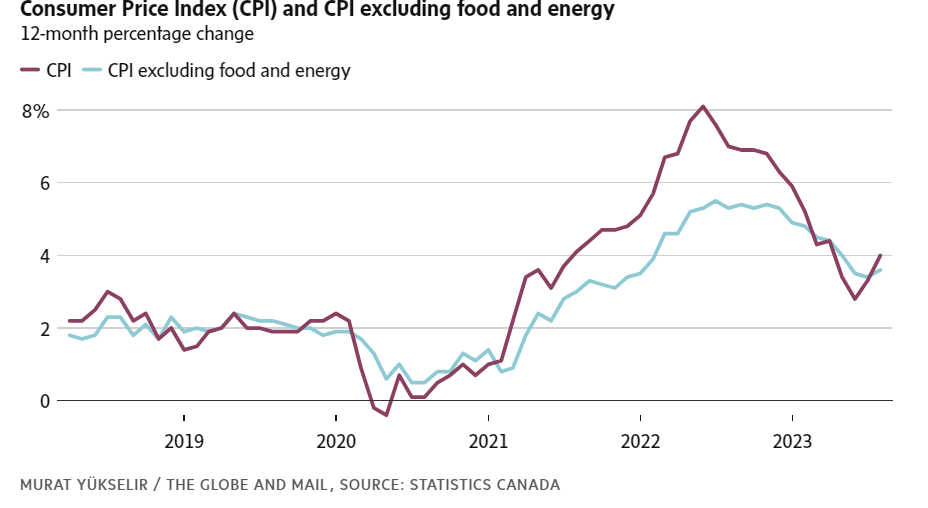

The Consumer Price Index rose 4 per cent in August from the year before, up from 3.3 per cent in July and the highest annual inflation rate since April, Statistics Canada said Tuesday. Bay Street analysts were expecting 3.8 per cent inflation in August.

The increase was driven by gasoline prices, which have surged in recent months following oil production cuts by Saudi Arabia and Russia. But it was more than just energy prices pushing up headline inflation.

Live updates: Canada’s inflation rate jumps to 4.0% in August

Rent was up 6.5 per cent year-over-year in August, compared to 5.5 per cent in July, and mortgage interest costs continued to tick higher for homeowners. Grocery price inflation decelerated to 6.9 per cent in August from 8.5 per cent the preceding month, but food inflation remains far above most other components of the consumer price index.

Most worrying for the Bank of Canada: Core measures of inflation, which filter out volatile price movements to get at underlying inflationary pressures, moved markedly higher. The average of the Bank of Canada’s two favourite core inflation measures rose to 4 per cent in August from 3.75 per cent the previous month. That’s twice the central bank’s 2-per-cent inflation target.

“We all knew that the extended back-up in gasoline prices was going to be a headache for headline CPI and inflation expectations, but the inconvenient truth is that core has suddenly heated up as well,” Bank of Montreal chief economist Douglas Porter said in a note to clients.

“There’s still lots of data to go before the [Bank of Canada] next decides on rates (October 25), including another swing at the CPI. Unfortunately, we suspect that with oil firing higher and core inflamed again, that report will be no better than today’s.”

Earlier this month, the Bank of Canada halted its monetary policy tightening campaign after 10 interest rate increases over the past year-and-a-half. This decision was taken after a string of data showed that economic growth in Canada has begun to stall and the labour market is cooling.

After the announcement, Bank of Canada Governor Tiff Macklem said that the bank’s inflation target was “now in sight” and that interest rates “may be sufficiently restrictive,” although he left the door open to more rate increases if inflation proved stubborn. Higher interest rates make it more expensive for individuals and businesses to borrow money and service their debts, with the goal of reducing spending throughout the economy to lower upward pressure on prices.

“August’s inflation reading stands in contrast to other measures that have shown momentum cooling in Canada’s economy,” Leslie Preston, a senior economist at Toronto Dominion Bank, wrote in a note to clients.

“The housing market, and new home construction cooled in August, and the unemployment rate has risen half a percentage point over the past few months. Fortunately, the Bank of Canada will see another inflation report before its next rate decision on October 25th. We expect further signs of slowing will help the bank to continue to stand on the sidelines.”

Interest rate swap markets, which capture market expectations about future monetary policy decisions, are now pricing in around a 40 per cent chance of another rate hike in October, according to Refinitiv data. Before the August inflation data, markets were putting the odds of another rate hike at about one-in-five.

The inflation data caught traders by surprise. Bond prices were hammered and yields surged Tuesday morning as traders scrambled to increase their bets on interest rates moving higher and staying high for longer. The yield on two-year Government of Canada bonds jumped to 4.88 per cent, topping recent highs reached in July. The Canadian dollar initially surged, rising by about half a cent against the U.S. dollar, before giving back around half of that gain by early afternoon.

Inflation has come down considerably over the past year, when it hit a four-decade high of 8.1 per cent last June. But Tuesday’s data shows that the price for many goods and services continues to rise quickly, adding to widespread affordability concerns.

Food was one of the few bright spots in the August inflation data. Annual grocery price inflation fell to 6.9 per cent from 8.5 per cent in July. On a monthly basis, grocery prices were down 0.4 per cent. Prices for fruit, cereal and chicken rose at a slower year-over-year pace than in July; prices for frozen beef, coffee and tea and sugar and confectionary rose more rapidly.

Food inflation has become a major political issue. On Monday, the federal government summoned executives from Canada’s large grocery chains to Ottawa for a meeting about stabilizing food prices. The government has threatened unspecified tax measures if grocery stores don’t work to get food prices under control.

Mortgage interest costs, which have risen alongside the Bank of Canada’s interest rate increases, remain the single biggest driver of CPI inflation. They were up 30.9 per cent in August compared to a year before, which is a touch higher than in July.

This has led to accusations from some politicians that the Bank of Canada itself is the key driver of inflation. Bank officials disagree, arguing that pushing up prices in this one component of the index is necessary to slow price increases in other parts of the index. “It’s true that if we hadn’t raised interest rates, mortgage costs might be lower today, but inflation throughout the economy would be a much bigger problem for everyone,” Mr. Macklem said in a speech two weeks ago.

Sharon Kozicki, a deputy governor at the Bank of Canada, is scheduled to deliver a speech at 2pm ET on Tuesday, which will likely touch on today’s inflation numbers.

Leave a Reply

You must be logged in to post a comment.