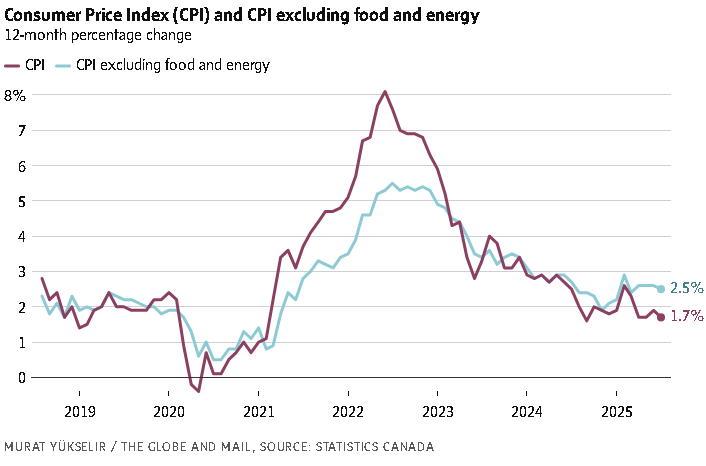

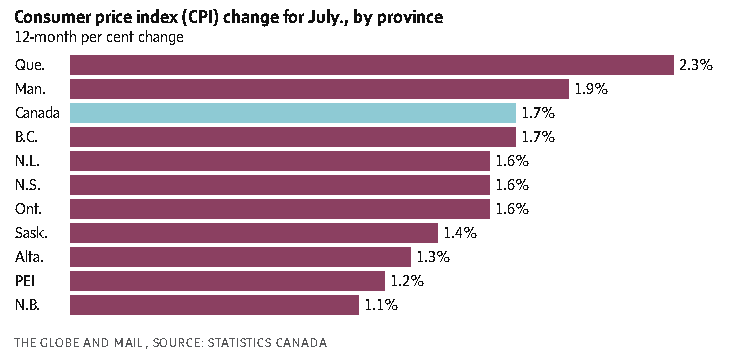

Canada’sinflation rate fell by slightly more than expected in July to 1.7 per cent, which economists say could pave the way for the Bank of Canada to resume cutting interest rates.

Statistics Canada’s consumer price index report on Tuesday said the deceleration from 1.9 per cent in June was led by a decline in gasoline prices, reflecting the removal of the consumer carbon price in the spring.

Meanwhile, grocery prices rose at a faster pace of 3.4 per cent annually. Shelter costs increased by 3 per cent from a year ago, fuelled by a 5.1-per-cent rise in rent and a more modest decline in residential natural gas prices compared with June.

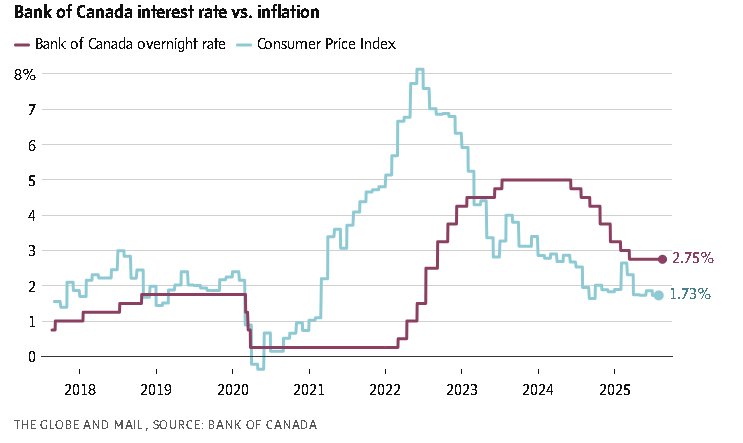

Financial markets reacted to the latest inflation data by increasing the odds of an interest rate cut in September to 36 per cent from 26 per cent the day before, according to data from Bloomberg.

Economists also responded positively to the report, noting that the slowdown could lead to an interest rate cut later this year.

“An easing in inflationary pressures during July means that we have successfully cleared one obstacle on the path towards a potential September interest rate cut,” said CIBC senior economist Andrew Grantham in a client note.

The Bank of Canada has held its key interest rate steady at 2.75 per centduring its last three announcements, noting the economy has held up relatively well despite the impact ofU.S. tariffs. It’s also been somewhat concerned by recent price pressures, which could worsen if the trade conflict escalates. (Businesses would likely pass down higher costs from tariffs on to consumers.)

U.S. tariffs have stalled economic growth in Canada as exports take a hit, but the economy has notgone into freefall.

The USMCA trade pact has allowed a significant chunk of goods to continue crossing the southern border tariff-free, enabling many businesses to avoid the steep levies U.S. President Donald Trump has imposed globally.

Modelling by the Bank of Canada suggests that if the tariff situation doesn’t change by much, Canada will likely avoid a recession and inflation will remain around the 2-per-cent target.

However, Governor Tiff Macklem has left the door open to rate cuts if the economy stalls and inflation remains at bay. Its recent summary of deliberations detailing discussions ahead of its July interest rate decision suggests that members of the governing council are split on whether more relief is needed.

Economists on Bay Street are somewhat more convinced that an interest rate reduction will be needed as slack continues to build in the economy, which is expected to offset some price pressures.

To gauge underlying price pressures, the Bank of Canada keeps a close eye on its preferred core measures of inflation, which did not ease in July, continuing to hover around 3 per cent annually.

However, BMO chief economist Douglas Porter noted that the three-month annualized trend for those measures eased to 2.4 per cent in July.

“If that more recent pace in core is maintained, and the economy remains soft, we believe that will eventually set the stage for BoC cuts,” Mr. Porter said in a client note.

The central bank’s next interest rate announcement is scheduled for Sept. 17.