Imperial Oil Ltd. raised its quarterly dividend by 20 per cent and reported its fourth-quarter profit fell compared with a year ago as it saw lower oil prices. The company says it will now pay a quarterly dividend of 87 cents per share, up from 72 cents per share. Imperial says it earned $492 million or $1.00 per diluted share for the final quarter of 2025 quarter compared with a profit of $1.23 billion or $2.37 per diluted share a year earlier. On an adjusted basis, Imperial says it earned $1.97 per diluted share in its latest quarter, down from an adjusted profit of $2.37 per diluted share a year earlier. Revenue and other income totalled $11.28 billion, down from $12.61 billion in the fourth quarter of 2024. Upstream production in the quarter averaged 444,000 gross oil-equivalent barrels per day, compared with 460,000 a year earlier. Refinery throughput averaged 408,000 barrels per day, compared with 411,000 barrels per day in the fourth quarter of 2024.

Author: Consultant

-

CN reports Q4 profit and revenue up from year ago, raises quarterly dividend

Canadian National Railway Co. raised its dividend as it reported its fourth-quarter profit and revenue rose compared with a year earlier. The railway says it will now pay a quarterly dividend of 91.5 cents per share, up from 88.75 cents per share. CN says it earned $1.25 billion or $2.03 per diluted share for the quarter ended Dec. 31, up from $1.15 billion or $1.82 per diluted share in the same quarter a year earlier. Revenue totalled $4.46 billion, up from $4.36 billion. On an adjusted basis, CN says it earned $2.08 per diluted share in its latest quarter, up from an adjusted profit of $1.82 per diluted share a year earlier. CN’s operating ratio — a key measure of efficiency and profitability for a railway — for the quarter was 61.2 per cent, an improvement from 62.6 per cent a year earlier. This report by The Canadian Press was first published Jan. 30, 2026.

-

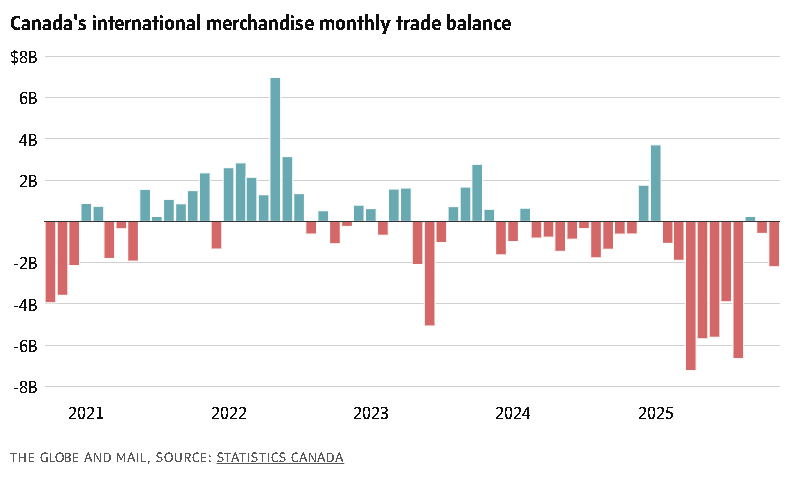

Canada’s trade deficit widens in November on drop in gold, auto shipments

Canada’s trade deficit widened in November as gold shipments plunged and exports of automobiles and parts hit a three-year low.

Goods exports declined 2.8 per cent while imports declined 0.1 per cent, Statistics Canada reported Thursday. That brought the merchandise trade deficit, the difference between goods imports and exports, to $2.2-billion in November from $395-million the month before.

The result was mainly owing to a massive swing in gold shipments, which have been a key but volatile driver of export growth over the past year. Excluding metal and non-metallic mineral products, the export picture looked more positive, rising 2.5 per cent and increasing in eight out of 11 categories.

Trade with the United States continued to slide, while there were some signs that Canada’s diversification push is gaining traction.

Only 56 per cent of imports came from the U.S., which is the lowest share since records began in 1997, excluding the pandemic, according to Bank of Montreal senior economist Shelly Kaushik. On the other side of the ledger, 68 per cent of Canadian exports went to the U.S., also well below historic norms.

“Looking through the volatility from energy and metals prices, it’s clear that Canadian trade flows remain under pressure as long as uncertainty stays elevated. Despite some support from diversification, trade headwinds will remain until we get certainty in the form of relief on sectoral tariffs and clarity on the future of USMCA,” Ms. Kaushik wrote in a note to clients, referring to the North American free-trade agreement.

Exports of services decreased 1.5 per cent in November, while services imports rose 0.5 per cent. This left services trade essentially in balance.

U.S. trade deficit widens by the most in nearly 34 years in November

Through much of 2025, gold was a star Canadian export, thanks to the extraordinary run-up in the price of the yellow metal. In September and October alone, the value of gold exports surged by $4.7-billion.

Gold exports then plunged by $3.2-billion in November. This was mostly driven by a decline in volumes – rather than prices – which fell 35 per cent month-to-month. Statscan noted a sharp drop in shipments to Britain, the United States and Hong Kong.

Since November, gold prices have continued their stratospheric rise, hitting a record US$5,500 an ounce earlier this week.

Exports of automobiles and parts also decreased 11.6 per cent from October to November. This was mainly the result of lower auto production in November, owing to a semiconductor shortage that has affected the auto industry, Statscan said.

Exports of heavy trucks and buses – which make up a much smaller part of the Canadian auto industry – declined 53.8 per cent following the introduction of U.S. tariffs on heavy vehicles at the start of November.

The decline in gold and auto exports was partly offset by an 8.5-per-cent rise in energy exports. Oil and crude bitumen exports rebounded after temporary shutdowns at refineries in the U.S. had curtailed shipments the month before.

Meanwhile, the value of imports declined slightly, falling in seven out of 11 categories, although this was driven by lower prices rather than lower volumes. There was a notable decline in energy and auto imports, balanced against by an increase in consumer goods and pharmaceutical imports.

“Smoothing through the noise, Canadian export volumes remain a few per cent below their pretariff levels. The recovery in Canada’s overall trade picture has been uneven, and businesses can anticipate challenging conditions in the months ahead,” Toronto-Dominion Bank economist Marc Ercolao wrote in a note to clients.

Ottawa, Seoul agree to work on bringing South Korean auto sector manufacturing to Canada

In the face of U.S. protectionism, Ottawa is trying to promote trade diversification. Prime Minister Mark Carney and his ministers have been travelling the world pursuing new trade agreements and trying to rustle up overseas business for Canadian companies. This includes the resumption of stalled trade talks with India and an agreement with China earlier this month to lower tariffs on a portion of electric vehicles in return for lower Chinese tariffs on Canadian canola and seafood products.

Trade with non-U.S. partners increased through 2025, particularly with Germany, Britain, China and Japan. And in November, exports to Germany rose 54 per cent, while exports to China rose 8.8 per cent.

“Canada’s recent strategic partnership with China may alleviate some strain in key sectors like autos and agriculture. But the future of North American trade will be highly contingent on the outcome of the upcoming review of the USMCA agreement,” Mr. Ercolao wrote.

The larger trade deficit will weigh on Canadian economic growth numbers in the fourth quarter, as net exports are added or subtracted from the GDP calculation. On Wednesday, the Bank of Canada published a new forecast, estimating that GDP growth essentially flatlined in the fourth quarter.

Statistics Canada will publish November GDP numbers on Friday.

-

Canadian Pacific Kansas City: Q4 Earnings Snapshot

Canadian Pacific Kansas City Limited (CP) on Wednesday reported fourth-quarter net income of $772.6 million.

The Calgary, Alberta-based company said it had net income of 86 cents per share. Earnings, adjusted for non-recurring costs, were 95 cents per share.

The results missed Wall Street expectations. The average estimate of eight analysts surveyed by Zacks Investment Research was for earnings of 99 cents per share.

The railroad posted revenue of $2.81 billion in the period, also falling short of Street forecasts. Six analysts surveyed by Zacks expected $2.87 billion.

For the year, the company reported profit of $2.96 billion, or $3.23 per share. Revenue was reported as $10.79 billion.

_____

This story was generated by Automated Insights (http://automatedinsights.com/ap) using data from Zacks Investment Research. Access a Zacks stock report on CP at https://www.zacks.com/ap/CP

-

Celestica: Q4 Earnings Snapshot

Celestica Inc. (CLS) on Wednesday reported fourth-quarter profit of $267.5 million.

On a per-share basis, the Toronto-based company said it had net income of $2.31. Earnings, adjusted for non-recurring gains, were $1.89 per share.

The results exceeded Wall Street expectations. The average estimate of three analysts surveyed by Zacks Investment Research was for earnings of $1.74 per share.

The electronics manufacturing services company posted revenue of $3.65 billion in the period, also topping Street forecasts. Three analysts surveyed by Zacks expected $3.47 billion.

For the year, the company reported profit of $832.5 million, or $7.16 per share. Revenue was reported as $12.39 billion.

For the current quarter ending in March, Celestica expects its per-share earnings to range from $1.95 to $2.15.

The company said it expects revenue in the range of $3.85 billion to $4.15 billion for the fiscal first quarter.

_____

This story was generated by Automated Insights (http://automatedinsights.com/ap) using data from Zacks Investment Research. Access a Zacks stock report on CLS at https://www.zacks.com/ap/CLS

-

Rogers shares jump as profit rises on strength in media, sports divisions

Rogers Communications Inc. RCI-B-T +3.64%increase posted moderately positive 2026 guidance and increases to its revenue and net income in its fourth quarter, boosted by strong media earnings as the company looks to capitalize on its sports assets in the coming year.

However, the company’s net new wireless mobile phone adds were much lower than last year, and other telecom metrics were either flat or down in the quarter, as the sector continues to face headwindsto growth.

The Toronto-based communications and entertainment company forecastedan increase inservice revenue of between 3 and 5 per cent in 2026 compared to last year, with expected growth of between 1 and 3 per cent in adjusted earnings before interest, taxes, depreciation and amortization.

Rogers expects capital expenditures to be below 2025 levels, and free cash flow to improve.

The guidance received a mild reaction from analysts.

“We view the results and 2026 guidance as largely neutral to a modest positive for the shares at current levels,” said Royal Bank of Canada analyst Drew McReynolds in a note to investors Thursday morning.

Telus alleges Bell ‘drastically degraded’ its ability to sign up new customers in CRTC complaint

Rogers reported $5.2-billion of service revenue during the three-month period ended Dec. 31, up 16 per cent from last year. Total revenue was $6.1-billion, beating analyst consensus of $6-billion.

Media revenue was up 126 per cent in the quarter, as a result of the Jul. 1 closing of Rogers’ acquisition of Bell’s former stake in Maple Leaf Sports & Entertainment, as well as the Toronto Blue Jays’ World Series run last fall and higher advertising revenue related to the ramp of up the company’s content deal with Warner Bros. Discovery Inc.

Net income was $710-million, up 27 per cent in the quarter compared to last year. Free cash flow was $1-billion, up 16 per cent, compared to analyst estimates of $943-million.

However, the company added just 39,000 postpaid and prepaid mobile wireless customers in the quarter, compared with 95,000 in 2025and analyst expectations of about 50,000. Net internet adds were 22,000, down from 26,000 last year.

More stories below advertisement

https://imasdk.googleapis.com/js/core/bridge3.740.0_en.html#deid=%22%22&eventfe_experiment_ids=%5B%5D&fid=%22goog_1995208839%22&genotype_experiment_data=%7B%22experimentStateProto%22%3A%22%5B%5B%5B45713128%2Cnull%2Cnull%2C%5B%5D%5D%2C%5Bnull%2C745150931%2Cnull%2C%5Bnull%2C1%5D%5D%2C%5Bnull%2C749060184%2Cnull%2C%5Bnull%2C128%5D%5D%2C%5B841585769%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45722344%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45706017%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45740207%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45668885%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45685340%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45734716%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45735891%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45663239%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45715032%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45661356%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B839547366%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45676441%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45675307%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45675308%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5Bnull%2C45645574%2Cnull%2C%5B%5D%5D%2C%5B45688859%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45656766%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45710689%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45710688%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45685601%2Cnull%2Cnull%2C%5B%5D%5D%2C%5Bnull%2C45685602%2Cnull%2C%5Bnull%2C500%5D%5D%2C%5B45747172%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B775241416%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B781107959%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B781107958%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B792614055%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B781107957%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45729602%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45658982%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45725657%2Cnull%2Cnull%2C%5B%5D%5D%5D%2C%5B%5B16%2C%5B%5B1%2C%5B%5B31089630%5D%2C%5B31089631%2C%5B%5B45668885%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5B1000%2C%5B%5B95332046%5D%5D%5D%2C%5Bnull%2C%5B%5B95332047%5D%5D%5D%2C%5B10%2C%5B%5B95333808%5D%2C%5B95333809%2C%5B%5B635466687%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5B10%2C%5B%5B95338769%2C%5B%5Bnull%2C45645574%2Cnull%2C%5Bnull%2C1%5D%5D%5D%5D%2C%5B95338770%2C%5B%5Bnull%2C45645574%2Cnull%2C%5Bnull%2C2%5D%5D%5D%5D%5D%5D%2C%5B50%2C%5B%5B95345206%5D%2C%5B95345207%2C%5B%5B45661356%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5B1%2C%5B%5B95351425%5D%2C%5B95351426%2C%5B%5B45676441%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5B20%2C%5B%5B95356068%5D%2C%5B95356069%2C%5B%5B45685601%2Cnull%2Cnull%2C%5B%5D%5D%2C%5Bnull%2C45685602%2Cnull%2C%5B%5D%5D%5D%5D%2C%5B95356070%2C%5B%5B45685601%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5Bnull%2C45685602%2Cnull%2C%5B%5D%5D%5D%5D%2C%5B95356071%2C%5B%5B45685601%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5Bnull%2C45685602%2Cnull%2C%5Bnull%2C100%5D%5D%5D%5D%5D%5D%2C%5B1%2C%5B%5B95373378%2C%5B%5B792614055%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%2C%5B95373379%2C%5B%5B45747172%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B781107959%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B792614055%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B781107957%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5Bnull%2C%5B%5B95375930%5D%2C%5B95375931%2C%5B%5B45734716%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%2C%5B95376520%2C%5B%5B45734716%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45735891%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5Bnull%2C%5B%5B95378095%5D%2C%5B95378096%2C%5B%5B45740207%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5B10%2C%5B%5B95378629%5D%2C%5B95378630%2C%5B%5B45729602%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%5D%5D%5D%2Cnull%2Cnull%2C%5Bnull%2C1000%2C1%2C1000%5D%5D%22%7D&imalib_experiments=%5B95320805%2C95322027%2C95331589%2C95332046%5D&is_eap_loader=false&managed_js_experiment_id=0&page_correlator=2410345275066716&pvsid=5241814249821175&top_accessible_page_url=%22https%3A%2F%2Fwww.theglobeandmail.com%2Fbusiness%2Farticle-rogers-results-earnings-fourth-quarter-sports-media-divisions%2F%22

Meanwhile, the company’s average revenue per user – or ARPU, an important industry metric that measures the value of each subscriber – fell by 2.8 per cent, confirming analyst expectationsthat itwould continue to drag this year.

Nonetheless, the company’s revenue from its telecom business remained essentially flat compared to last year, and churn – the rate of customer turnover on a monthly basis – among its postpaid wireless customers improved slightly.

The industry is seeing a bumpy landscape for cellphone plan pricing and the effects of these hikes on financials.

Cellphone plans could be getting more expensive after years of falling prices, data suggest

In recent months, cellphone plan prices appeared broadly to have started to increase again after years of declines. Analysts celebrated the turn in trend, but have noted that its effect will take time to reach the bottom line, given that many subscribers are locked into two-year contracts and the number of new consumers has been curtailed by slow immigration.

Yet in recent weeks, telecoms have turned back to steep promotions. In an earnings call Thursday morning, Rogers chief financial officer Glenn Brandt said the company’s rivals were offering “unsustainable discounting” through January.

Chief executive officer Tony Staffieri said the company is instead focusing on growing margins by moving away from value propositions that rely solely on price, and offering tiered plans based on other benefits such as direct-to-cell satellite service.

“There are certain price points that we see as being uneconomical. We don’t see building out wireless business on the back of price plans coming in at, say, $20, which is what you see in the marketplace today. We don’t get the logic on that,” he said.

Rogers is planning to monetize its sports assets this year upon the planned acquisition of the remaining 25-per-cent portion of MLSE from Canadian businessman Larry Tanenbaum’s company, Kilmer Group. Rogers has the right to buy that share in July. The company has estimated that its sports assets will then be worth about $20-billion.

Selling a minority stake could help the company pay down its $35.8-billion of long-term debt.

Rogers was trading at $49.50 on the Toronto Stock Exchange before markets opened Thursday, down about 5.6 per cent from the beginning of the year but up more than 12 per cent from this time last year.

-

Fed holds key interest rate steady as economic view improves

- The Federal Reserve held its key interest steady in a range between 3.5% and 3.75% after a recent run of interest rate cuts.

- “Available indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained low, and the unemployment rate has shown some signs of stabilization,” the central bank said in its post-meeting statement. “Inflation remains somewhat elevated.”

https://www.cnbc.com/2026/01/28/fed-rate-decision-january-2026.html

-

Oil prices rise after Trump says a ‘massive Armada is heading to Iran’

Crude oil prices rose Wednesday after President Donald Trump warned Iran that a “massive Armada” is heading in its direction and time is running out to make a deal on its nuclear program.

Global benchmark Brent rose 55 cents, or 0.81%, to $68.12 per barrel by 10:33 a.m. ET. U.S. crude oil was up 63 cents, or 1.01%, to $63.02.

“A massive Armada is heading to Iran. It is moving quickly, with great power, enthusiasm, and purpose,” Trump said in a post on his social media platform Truth Social on Wednesday.

U.S. Central Command said Monday that the Abraham Lincoln Carrier Strike Group had arrived in the Middle East “to promote regional security and stability.”

Trump had threatened to attack Iran if it killed protestors during a mass uprising earlier this month. Thousands of people died after the Islamic Republic cracked down on the unrest. But the U.S. president has held back from military intervention so far.

Trump said the fleet deployed to the Middle East is larger than the forces he ordered to the Caribbean before the U.S. captured former Venezuelan President Nicolas Maduro.

“Like with Venezuela, it is, ready, willing, and able to rapidly fulfill its mission, with speed and violence, if necessary,” Trump said of the carrier strike group Tuesday in the social media post.

He called for Tehran to make a deal on its nuclear program.

“Time is running out, it is truly of the essence! As I told Iran once before, MAKE A DEAL!,” Trump said.

The president warned Iran that a possible attack would be worse than the bombing campaign he ordered last June on the Islamic Republic’s nuclear facilities.

“The next attack will be far worse! Don’t make that happen again,” he said.

-

METRO REPORTS 2026 FIRST QUARTER RESULTS

2026 FIRST QUARTER HIGHLIGHTS

- Sales of $5,285.8 million, up 3.3%

- Food same-store sales (1) up 1.6% and up 1.9% when adjusting for the Christmas shift (3)

- Pharmacy same-store sales (1) up 3.9%

- Net earnings of $226.3 million, down 12.8% and adjusted net earnings (1) of $248.7 million, up 1.3%

- Fully diluted net earnings per share of $1.05, down 9.5% and adjusted fully diluted net earnings per share (1) of $1.16, up 5.5%

- Earnings adjusted for the negative impact of $15.9 million ($21.6 million before taxes) for the direct costs related to the temporary shutdown of our frozen food distribution centre in Toronto

- Declared dividend of $0.4075 per share, up 10.1% versus last year

https://www.barchart.com/story/news/37253485/metro-reports-2026-first-quarter-results