Before the Bell: Oct 11

Equities

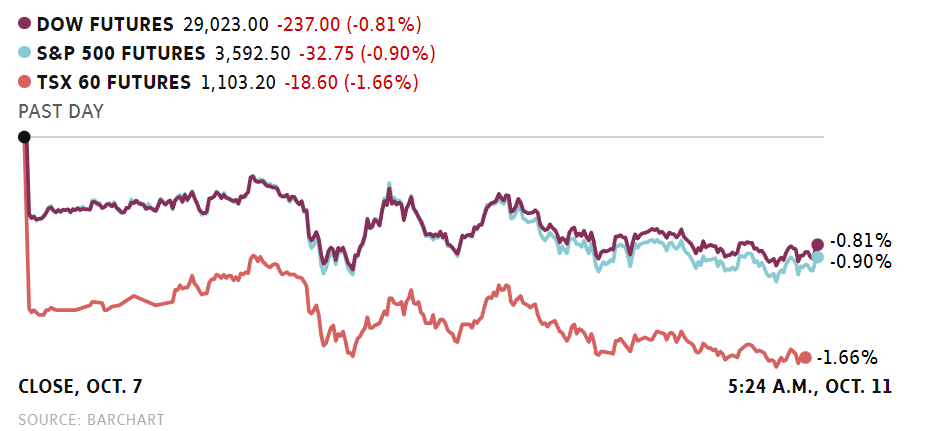

Wall Street futures were lower early Tuesday signalling continued losses as traders await earnings from some of the biggest U.S. banks and new inflation figures later in the week. Major European markets were down in morning trading. TSX futures also fell alongside weaker crude prices.

In the early premarket period, all three key U.S. indexes were in the red. On Monday, the Nasdaq lost 1.04 per cent, touching a two-year low. The S&P 500 lost 0.75 per cent while the Dow ended down 0.32 per cent. The S&P/TSX Composite Index was closed Monday for the Thanksgiving holiday.

Recession concerns continue to weigh on sentiment. JPMorgan Chase & Co CEO Jamie Dimon cautioned that the U.S. and world economies could slip into recession by the middle of next year. World Bank President David Malpass and International Monetary Fund Managing Director Kristalina Georgieva also warned on Monday of a growing risk of global recession.

“Risk sentiment is morose this week with the escalating tensions in Ukraine, rising COVID cases in China, mounting tensions between U.S. and China, the selloff in U.S. and other treasuries, the relentless appreciation in the U.S. dollar and the drop in safe haven currencies,” Swissquote senior analyst Ipek Ozkardeskaya said in an early note.

Reuters reports that Ukraine President Volodymyr Zelenskiy is expected to ask the leaders of the G7 group of nations to urgently supply Ukraine with weapons to defend itself from Russian missiles, a day after Moscow launched retaliatory strikes that killed 19 people.

Meanwhile, COVID-19 concerns in China continue to weigh on sentiment with authorities in Shanghai and other big cities stepping up testing amid rising infections.

Later in the week, investors will get third-quarter results from U.S. banks JPMorgan, Morgan Stanley and Wells Fargo. All three are scheduled to release results on Friday morning.

On the economic side, a fresh reading on U.S. inflation is due Thursday. Economists are expecting the annual rate of inflation to slow to 8.1 per cent in September from 8.3 per cent a month earlier.

In this country, investors get results from fashion retailer Aritzia after the close of trading on Wednesday.

Canada’s housing market is also in focus with new home sales figures from the Canadian Real Estate Association due on Friday. Last month, CREA cut its sales forecast and lowered its outlook for price growth.

Overseas, the pan-European STOXX 600 was down nearly 1 per cent in morning trading. Britain’s FTSE 100 lost 1.16 per cent. Germany’s DAX fell 0.85 per cent and France’s CAC 40 was off 0.74 per cent.

In Asia, Japan’s Nikkei slumped 2.64 per cent. Hong Kong’s Hang Seng lost 2.23 per cent.

Commodities

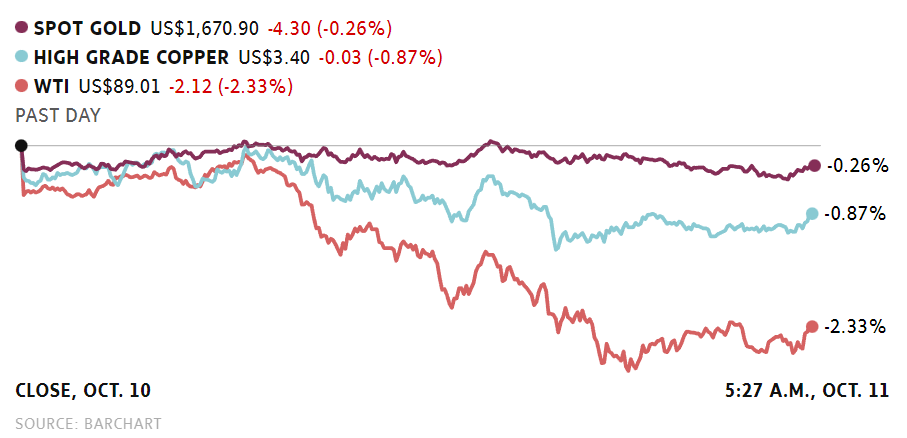

Crude prices fell in early going, hit by ongoing fears of a global recession and concerns over rising COVID-19 cases in China.

The day range on Brent is US$96.46 to US$94.08. The range on West Texas Intermediate is US$91.35 to US$88.74.

“Oil prices are paring recent gains for the second day as the IMF and World Bank warn of an increased risk of a global recession,” OANDA senior analyst Craig Erlam said.

“Those warnings won’t come as an enormous surprise given the immense economic headwinds as a result of the pandemic and Russia’s invasion of Ukraine, not to mention the baffling decision by OPEC+ last week to cut output by two million barrels per day which will only add to them.”

In other commodities, gold prices fell, pressured by continued strength in the U.S. dollar.

Spot gold was down 0.1 per cent at US$1,665.89 per ounce by early Tuesday morning, after earlier touching its lowest since Oct. 3. U.S. gold futures slid 0.1 per cent to US$1,672.60.

“The rally in gold always looked like it was going to be difficult to sustain in an environment of higher government bond yields and a dominant [U.S.] dollar,” Mr. Erlam said.

“And it has well and truly wilted over the last week, initially easing off its highs before totally giving up as it collapsed through US$1,700 before stabilizing a little today around US$1,660.”

Currencies

The Canadian dollar was down in early going as risk sentiment remains fragile and crude prices fell. The loonie’s U.S. counterpart, meanwhile, edged higher against a group of world currencies as investors sought out safer holdings.

The day range on the loonie is 72.17 US cents to 72.63 US cents.

There were no major economic Canadian economic releases on Tuesday’s calendar. On Friday, Statistics Canada will release factory and wholesale sales figures for August.

“The data calendar is light as the market awaits U.S. CPI later this week for further market direction,” Elsa Lignos, global head of FX strategy, said in a note.

“Without signs of cooling inflation, it is very hard to pivot. We disagree with those who argue equity softness alone will do it for the Fed – recall at worst we’re just back to summer 2020 levels (in the Nasdaq) or the post 2020-election gap higher (S&P, Dow), both of which at the time were new all-time highsafter a very fast COVID-liquidity led recovery.”

The U.S. dollar index, which weighs the greenback against a group of world currencies, was up 0.2 per cent early Tuesday morning at 113.27, inching toward the 20-year high of 114.78 it touched late last month, according to figures from Reuters.

The euro was little changed at US$0.9699, after four days of losses.

Britain’s pound slid to its lowest level since Sept. 29 at US$1.0999. The pound was last down 0.4 per cent at US$1.10185, Reuters reports.

Early Tuesday, the Bank of England acted again to stem a sharp sell off in Britain’s 2.1 trillion-pound (US$2.31-trillion) government bond market by announcing the purchase of inflation-linked debt until the end of this week.

In bonds, the yield on the U.S. 10-year note was higher at 3.941 per cent in the predawn period.

Leave a Reply

You must be logged in to post a comment.