Rogers Communications Inc. RCI-B-T +3.64%increase posted moderately positive 2026 guidance and increases to its revenue and net income in its fourth quarter, boosted by strong media earnings as the company looks to capitalize on its sports assets in the coming year.

However, the company’s net new wireless mobile phone adds were much lower than last year, and other telecom metrics were either flat or down in the quarter, as the sector continues to face headwindsto growth.

The Toronto-based communications and entertainment company forecastedan increase inservice revenue of between 3 and 5 per cent in 2026 compared to last year, with expected growth of between 1 and 3 per cent in adjusted earnings before interest, taxes, depreciation and amortization.

Rogers expects capital expenditures to be below 2025 levels, and free cash flow to improve.

The guidance received a mild reaction from analysts.

“We view the results and 2026 guidance as largely neutral to a modest positive for the shares at current levels,” said Royal Bank of Canada analyst Drew McReynolds in a note to investors Thursday morning.

Telus alleges Bell ‘drastically degraded’ its ability to sign up new customers in CRTC complaint

Rogers reported $5.2-billion of service revenue during the three-month period ended Dec. 31, up 16 per cent from last year. Total revenue was $6.1-billion, beating analyst consensus of $6-billion.

Media revenue was up 126 per cent in the quarter, as a result of the Jul. 1 closing of Rogers’ acquisition of Bell’s former stake in Maple Leaf Sports & Entertainment, as well as the Toronto Blue Jays’ World Series run last fall and higher advertising revenue related to the ramp of up the company’s content deal with Warner Bros. Discovery Inc.

Net income was $710-million, up 27 per cent in the quarter compared to last year. Free cash flow was $1-billion, up 16 per cent, compared to analyst estimates of $943-million.

However, the company added just 39,000 postpaid and prepaid mobile wireless customers in the quarter, compared with 95,000 in 2025and analyst expectations of about 50,000. Net internet adds were 22,000, down from 26,000 last year.

More stories below advertisement

https://imasdk.googleapis.com/js/core/bridge3.740.0_en.html#deid=%22%22&eventfe_experiment_ids=%5B%5D&fid=%22goog_1995208839%22&genotype_experiment_data=%7B%22experimentStateProto%22%3A%22%5B%5B%5B45713128%2Cnull%2Cnull%2C%5B%5D%5D%2C%5Bnull%2C745150931%2Cnull%2C%5Bnull%2C1%5D%5D%2C%5Bnull%2C749060184%2Cnull%2C%5Bnull%2C128%5D%5D%2C%5B841585769%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45722344%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45706017%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45740207%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45668885%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45685340%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45734716%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45735891%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45663239%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45715032%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45661356%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B839547366%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45676441%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45675307%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45675308%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5Bnull%2C45645574%2Cnull%2C%5B%5D%5D%2C%5B45688859%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45656766%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45710689%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45710688%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45685601%2Cnull%2Cnull%2C%5B%5D%5D%2C%5Bnull%2C45685602%2Cnull%2C%5Bnull%2C500%5D%5D%2C%5B45747172%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B775241416%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B781107959%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B781107958%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B792614055%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B781107957%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45729602%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45658982%2Cnull%2Cnull%2C%5B%5D%5D%2C%5B45725657%2Cnull%2Cnull%2C%5B%5D%5D%5D%2C%5B%5B16%2C%5B%5B1%2C%5B%5B31089630%5D%2C%5B31089631%2C%5B%5B45668885%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5B1000%2C%5B%5B95332046%5D%5D%5D%2C%5Bnull%2C%5B%5B95332047%5D%5D%5D%2C%5B10%2C%5B%5B95333808%5D%2C%5B95333809%2C%5B%5B635466687%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5B10%2C%5B%5B95338769%2C%5B%5Bnull%2C45645574%2Cnull%2C%5Bnull%2C1%5D%5D%5D%5D%2C%5B95338770%2C%5B%5Bnull%2C45645574%2Cnull%2C%5Bnull%2C2%5D%5D%5D%5D%5D%5D%2C%5B50%2C%5B%5B95345206%5D%2C%5B95345207%2C%5B%5B45661356%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5B1%2C%5B%5B95351425%5D%2C%5B95351426%2C%5B%5B45676441%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5B20%2C%5B%5B95356068%5D%2C%5B95356069%2C%5B%5B45685601%2Cnull%2Cnull%2C%5B%5D%5D%2C%5Bnull%2C45685602%2Cnull%2C%5B%5D%5D%5D%5D%2C%5B95356070%2C%5B%5B45685601%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5Bnull%2C45685602%2Cnull%2C%5B%5D%5D%5D%5D%2C%5B95356071%2C%5B%5B45685601%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5Bnull%2C45685602%2Cnull%2C%5Bnull%2C100%5D%5D%5D%5D%5D%5D%2C%5B1%2C%5B%5B95373378%2C%5B%5B792614055%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%2C%5B95373379%2C%5B%5B45747172%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B781107959%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B792614055%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B781107957%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5Bnull%2C%5B%5B95375930%5D%2C%5B95375931%2C%5B%5B45734716%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%2C%5B95376520%2C%5B%5B45734716%2Cnull%2Cnull%2C%5B1%5D%5D%2C%5B45735891%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5Bnull%2C%5B%5B95378095%5D%2C%5B95378096%2C%5B%5B45740207%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%2C%5B10%2C%5B%5B95378629%5D%2C%5B95378630%2C%5B%5B45729602%2Cnull%2Cnull%2C%5B1%5D%5D%5D%5D%5D%5D%5D%5D%5D%2Cnull%2Cnull%2C%5Bnull%2C1000%2C1%2C1000%5D%5D%22%7D&imalib_experiments=%5B95320805%2C95322027%2C95331589%2C95332046%5D&is_eap_loader=false&managed_js_experiment_id=0&page_correlator=2410345275066716&pvsid=5241814249821175&top_accessible_page_url=%22https%3A%2F%2Fwww.theglobeandmail.com%2Fbusiness%2Farticle-rogers-results-earnings-fourth-quarter-sports-media-divisions%2F%22

Meanwhile, the company’s average revenue per user – or ARPU, an important industry metric that measures the value of each subscriber – fell by 2.8 per cent, confirming analyst expectationsthat itwould continue to drag this year.

Nonetheless, the company’s revenue from its telecom business remained essentially flat compared to last year, and churn – the rate of customer turnover on a monthly basis – among its postpaid wireless customers improved slightly.

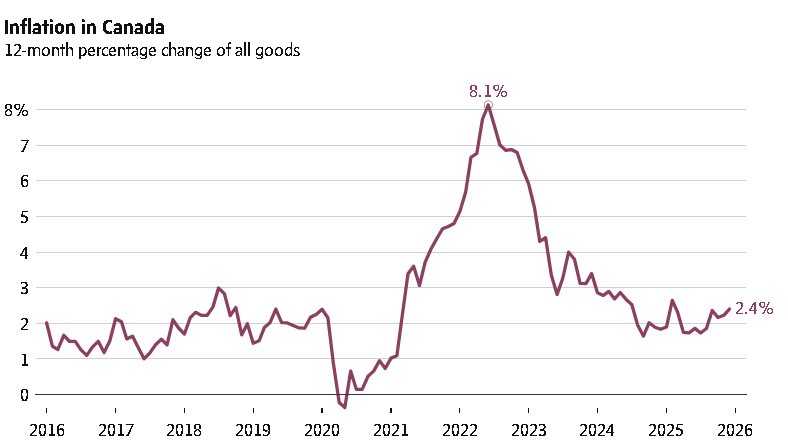

The industry is seeing a bumpy landscape for cellphone plan pricing and the effects of these hikes on financials.

Cellphone plans could be getting more expensive after years of falling prices, data suggest

In recent months, cellphone plan prices appeared broadly to have started to increase again after years of declines. Analysts celebrated the turn in trend, but have noted that its effect will take time to reach the bottom line, given that many subscribers are locked into two-year contracts and the number of new consumers has been curtailed by slow immigration.

Yet in recent weeks, telecoms have turned back to steep promotions. In an earnings call Thursday morning, Rogers chief financial officer Glenn Brandt said the company’s rivals were offering “unsustainable discounting” through January.

Chief executive officer Tony Staffieri said the company is instead focusing on growing margins by moving away from value propositions that rely solely on price, and offering tiered plans based on other benefits such as direct-to-cell satellite service.

“There are certain price points that we see as being uneconomical. We don’t see building out wireless business on the back of price plans coming in at, say, $20, which is what you see in the marketplace today. We don’t get the logic on that,” he said.

Rogers is planning to monetize its sports assets this year upon the planned acquisition of the remaining 25-per-cent portion of MLSE from Canadian businessman Larry Tanenbaum’s company, Kilmer Group. Rogers has the right to buy that share in July. The company has estimated that its sports assets will then be worth about $20-billion.

Selling a minority stake could help the company pay down its $35.8-billion of long-term debt.

Rogers was trading at $49.50 on the Toronto Stock Exchange before markets opened Thursday, down about 5.6 per cent from the beginning of the year but up more than 12 per cent from this time last year.